Year-2019 has been conducive for the Bitcoin prices so far, it has been spiking constantly higher from the last couple of weeks, rose from the lows of $3,122 levels to the recent highs of $13,880 levels which is the 2019 highs (i.e. almost more than 344% in this year so far). We are now on the verge of hitting multi-month highs as it breaks-out $11k and 11.5k mark.

Bitcoin price has been sensing new all-time-highs with regards to its hash-rate, indicating that hash-rate is a good leading indicator of price actions.

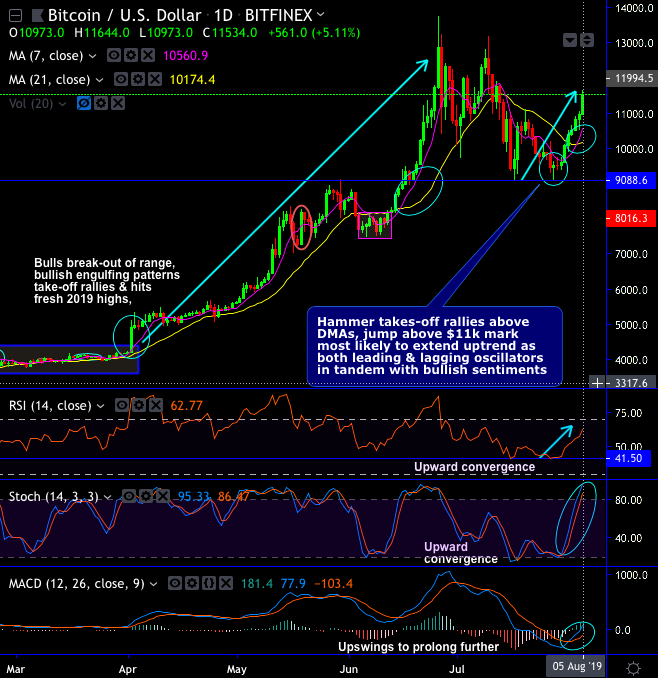

Technically, after BTCUSD has bottomed out at $3,122 levels, consequently, bullish engulfing pattern has occurred at $4,071.70 levels.

The hammer pattern occurred at $9,519 level that takes-off rallies above DMAs, jump above $11k mark most likely to extend uptrend as both leading and lagging oscillators are in tandem with the bullish sentiments.

Ever since then the pair kept spiking higher constantly, it has now gone above 21-DMAs Thereby, the pair hits the psychological price levels of $5k mark. Followed by, the majority of the crypto fraternity experienced the middling performance with a few select altcoin markets surging strongly.

To substantiate this bullish sentiment, all technical indicators are in line with the price upswings.

Both RSI and Stochastic curves show upward convergence to the prevailing rallies that indicate the intensified buying momentum.

While lagging indicators (MACD on daily and monthly terms) show bullish crossovers, that also signals uptrend to prolong further in the weeks to come.

On the back of these bullish price sentiments, we could foresee more bullish prospects in the pioneer cryptocurrency (Bitcoin) price and its counterparts sensed eye-catchy market-capitalization growth in the recent past.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?