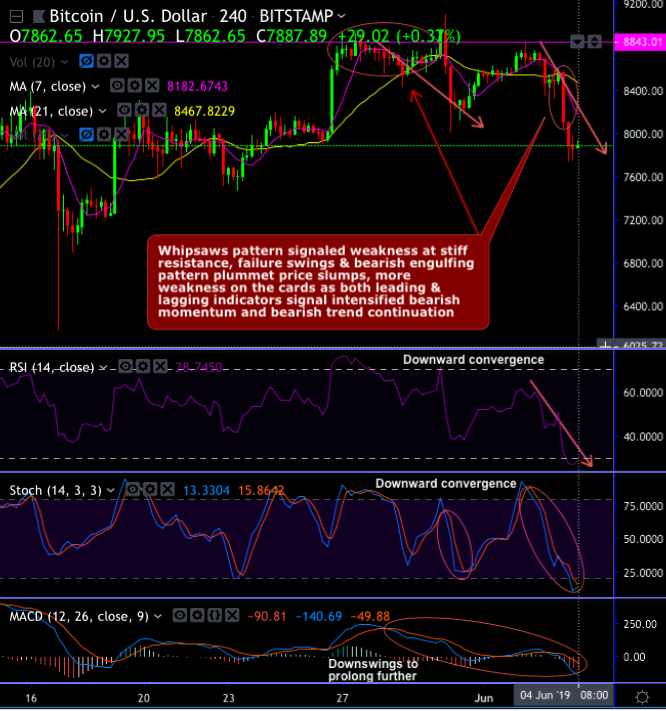

We emphasized the skepticism on BTCUSD’s further bullish prospects at $9,096 levels while highlighting whipsaw pattern in our technical section.

Whipsaws pattern, at the stiff resistance of $8,843 levels, signaled weakness, consequently, the failure swings were observed. As a result, the bearish engulfing pattern has occurred at 8,103.64 level to plummet prices way below DMAs. More weakness seems to be on the cards as both leading & lagging indicators signal intensified bearish momentum and bearish trend continuation. For now, it is trading sideways and exhibiting little to no drive for an upward push.

Contrary to this bearish stance, Bitcoin has been spiking higher from the last couple of weeks, rose from the lows of $3,405.30 levels to the current $5,298.60 levels which is almost more than 37% so far (i.e. 10% in March, 28.64% in April and 62.22% May month series).

After it has bottomed out at $3,215.20 levels, consequently, the bullish engulfing pattern has occurred at $4,071.70 levels.

Ever since then the pair kept spiking higher constantly, it has now gone above 21-DMAs Thereby, the pair hits the psychological price levels of the $5k mark. Followed by, the majority of the crypto fraternity experienced the middling performance with a few select altcoin markets surging strongly.

To substantiate this bullish sentiment, all technical indicators are in line with the price upswings.

Both RSI and Stochastic curves show upward convergence to the prevailing rallies that indicate the intensified buying momentum.

While lagging indicators (MACD on daily and monthly terms) show bullish crossovers, that also signals uptrend to prolong further in the weeks to come.

Most importantly, it is claimed by Coindesk that the record highs of open positions in CME’s bitcoin futures have ever reported and a 7% increase over the previous week.

The increase in futures trading activity may be due to an indication of mounting institutional interest in bitcoin, as per their report.

One can infer this as buyer builds fresh longs and seller builds fresh shorts when OI increases. Here, in this case, it is good news for crypto-aspirants that new participants for bitcoin derivatives have been added.

Overall, it is the right time for bears in the short-term and for bulls in the long run. Usually, what happens is that the volume and open interests would be small at the early stages of futures contract life and expands as it reaches the maturity period and again drops during the close to expiration stage.

Currency Strength Index: FxWirePro's hourly BTC spot index is inching towards -159 levels (which is highly bearish), USD is at -127 (highly bearish), while articulating (at 08:34 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?