For some of the emerging market currencies, recent rout has been worst since financial crisis (2008/09), for some worst since Asian currency crisis (1997), for some worst since Taper Tantrum (2013) and for some, worst on record.

China's recent devaluation of Yuan just increased the pain of emerging market FX, which lost further grounds and fast since China's devaluation. Debasing Yuan just pulled an anchor for emerging market currencies, especially Asian ones.

Market participants are worried that China might be weaker than many had originally assumed, which is overall bad news for emerging markets. China consumes lot of exports of emerging market and with further slowdown in mainland, risks emerging markets.

Moreover, speculation has been going up for further devaluation from China, either controlled or uncontrolled.

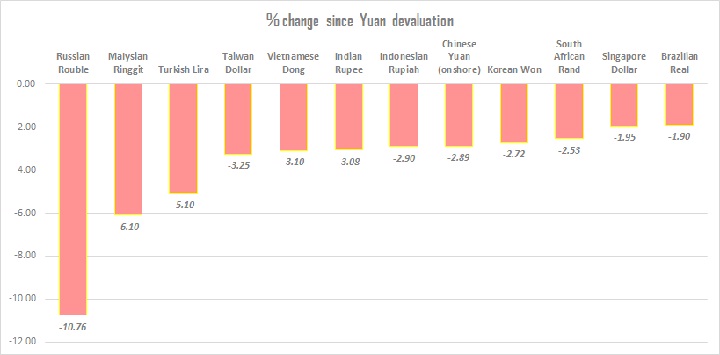

The chart represents some of the prominent emerging market's currencies since first devaluation of Yuan on August 11th. Drop would be larger if today's move is considered, data till Friday.

- Rouble is leading the way with-10.76% drop (oil price drop has contributed to the fall), followed by Malaysian Ringgit (-6.10%), Turkish Lira (-5.10%), Taiwan Dollar (-3.25%), Vietnamese Dong (-3.10%), Indian Rupee (-3.08%), Indonesian Rupiah (-2.90%), Korean Won (-2.72%), South African Rand (-2.53%), Singapore Dollar (-1.95%) and Brazilian Real (-1.9%).

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings