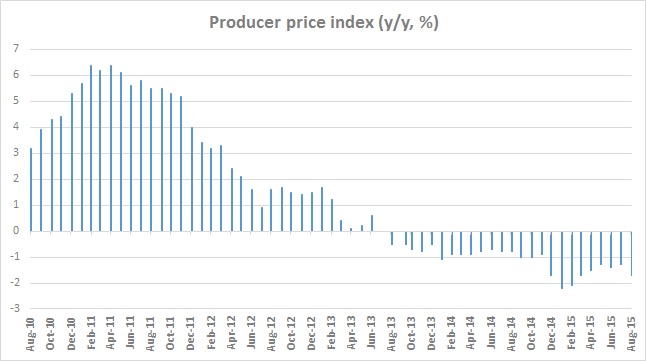

German gauge for factory prices continued to drop for 25 consecutive month and in August it dropped more than median expectation of the market.

- Producer prices dropped by -0.5% in August from July, down -1.7% on yearly basis. In July annualized drop was -1.3%.

According to analysts, producer price deflation continue to pose weakness in domestic economy along with fall in commodity prices, which despite weaker Euro, affecting prices.

German economy grew 0.4% for three months to June, lower than expected 0.5%.

European Central Bank (ECB), which started its asset purchase program, only back in March, is now facing increasing pressure to react further as slowdown in emerging markets and China is likely to slow down growth and intensify deflationary pressure.

ECB officials including chief economist Peter Paret over the weekend hinted that ECB stands ready to act and modify its existing asset purchase program to provide further support.

If another set of turmoil reemerges from China or emerging markets, like that of August, Euro might start taking hit over raising bets of further easing from ECB.

Euro is currently trading at 1.128 against Dollar.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand