Gambling dollar against euro proved the world's repute hedge fund managers success since last 1 and half years. The euro slumps have fetched a much-needed pick up to the hedge funds that have been repeatedly frustrated by the world's central banks.

For an instance, a bevy of multibillion-dollar funds have gained as much as 9% this year as their fund managers were bearish against the euro, riding the ECB's push to weaken the currency and bolster Europe's economy.

Euro's short build ups against the dollar reached a low recently When the Fed decided not to hike in September.

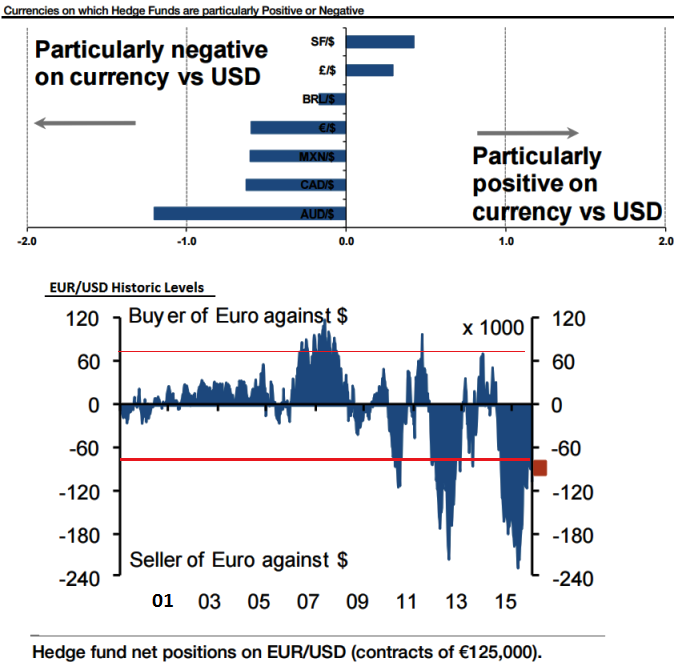

At only 62,000 shorts as recently as 20 October, they have reached the 'least negative' point in over a year (see charts red line portion).

However, net short positions of euro versus the dollar were already well beyond historical levels (maximum shorts were reached in March during the height of Grexit fears), and then they were reduced even more.

Sensing renewed upside potential for the US dollar the decision for a December lift-off will be mostly data dependent and the labour market data to be published this week will weigh heavy in the Fed's evaluation.

With some sort auxiliary impetus from ECB's Draghi through a dovish stance (we expect the ECB to extend QE, potentially before year-end), hedge funds must be sensing renewed upside potential for the US dollar and so are increasing their net short euro positions.

Hence, we reckon the December month would be crucial for hedge fund positions, either long or short, tend to reveal valuable insights on financial market trends.

December month likely to decide prospects of dollar’s hedge fund portfolio

Thursday, November 5, 2015 11:14 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?