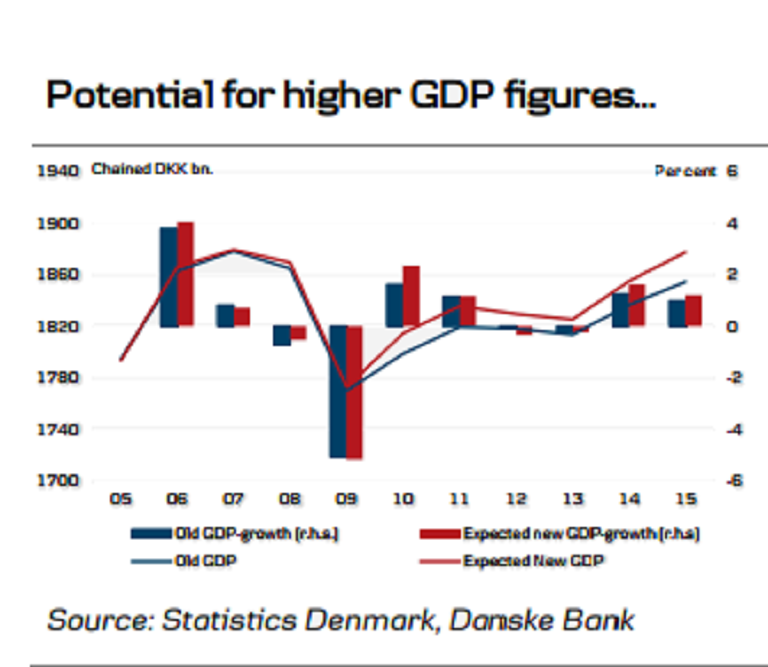

The Danish economy is expected to perform better than previously expected, following upbeat production of goods by businesses abroad, and goods resold by Danish companies abroad are also set to increase significantly. However, no new dramatic changes are expected in the upcoming growth figures.

The current account data suggest that the revision of higher goods exports up until 2009 will be largely offset by an increase in services imports. Imported services have been driven higher especially by upward adjusted purchases of manufacturing services, as well as royalty payments and rights. From here on the increase in goods exports should move GDP higher.

Looking at the past twelve months, the current account data will hardly prompt major reconsiderations of current cyclical trends, although there is potential for a little more growth. Shifts may occur from quarter to quarter but the overall H1 growth rate looks fairly stable and will probably not change much.

However, the revised GDP data will also reflect many other revisions than those following from the new current account statistics, meaning that the GDP figures may be higher, or lower, than projected.

"Our estimates show the new current account data could potentially lift 2015 GDP by more than one percent," Danske Bank commented in its recent research note.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices