We don’t know whether it’s been a CME’s coincidence or deliberate price action of the underlying security which is bitcoin, whenever they introduced derivatives products of bitcoin, we witnessed dramatic price action.

Since CME has launched options trading mechanism for Bitcoin (13th Jan), the underlying price has surged above $8,800 on January 14th.

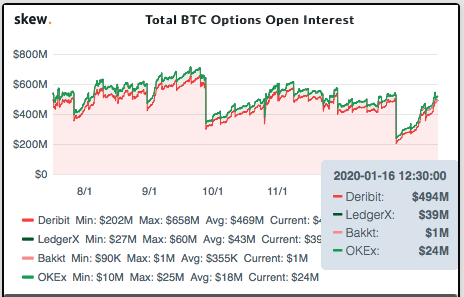

While this would not be the first Bitcoin option contract (there are already option contracts actively traded at Derebit and LedgerX), this launch is widely anticipated given the dominance of CME in trading bitcoin futures in regulated exchanges. Admittedly, ICE and Bakkt also introduced option contracts on Dec 9th 2019 that settle into the underlying physically-delivered monthly futures contract.

The pioneer cryptocurrency has been travelling within a firm uptrend especially during Christmas and New-Year series that has led it to spike to 2-months highs, i.e. as high as $8,900 levels.

Although BTC has been attempting inch higher against some sort of resistance, but uptrend remained intact within its upper $8k range without paying any heads to the apparent overbought sentiments and not budging its current trend indicates that the ongoing uptrend is likely to intensify further.

And it seem to be evident in the bitcoin options market, although BTC options traders concur with this assumption, as trading volume on Bitcoin options hit a near-record high in the recent past. One can easily make out that rising open interest (OI) and volumes build-ups (refer both the charts shown above) while the underlying price is travelling northwards.

In addition, we’ve got lot of renowned OTC players, such as, LedgerX, OKEx, Derbit, etc are also lined up with various derivatives products especially the options markets for bitcoin.

In the over-the-counter (OTC) market , virtually every term of option contracts is negotiated, but this greatly reduces liquidity of the option. To increase liquidity and trading activity, organized exchanges standardized the terms of option contracts, such as the number of shares that each contract represents, or the strike prices that are allowable.

Most option contracts traded on regulated exchanges, CME and Bakkt are just called as ‘puts and calls’, wherein the most cases, the trader simply specifies strike price, expiration month, and quantity.

However, there are some contracts that differ significantly from the standardized options traded on exchanges, but that have terms common enough to warrant their own names, and are grouped under the genus exotic options, contrasting them to the standardized vanilla options, sometimes called more pretentiously as plain-vanilla options. Courtesy: Skew & CME

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different