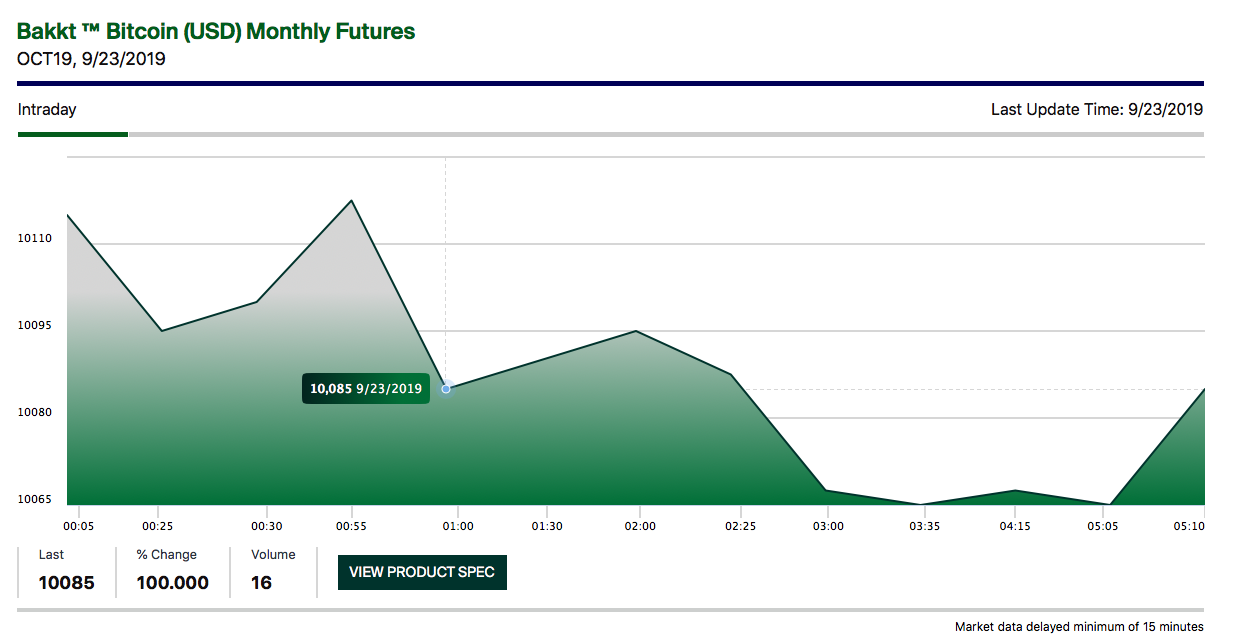

Bakkt’s has gone live as scheduled on 23rd September but with a mild start, the clients’ bitcoins are now stored in the Bakkt warehouse which is functioned by Bakkt Trust Company Llc who assumes to be a qualified custodian, regulated by the NYSDFS (New York State Department of Financial Services).

The Bitcoin (BTC) futures with the settlement arrangement of physical delivery has shown the total trading volume on the platform at the time of articulating is only 17 Bitcoins trading at $10,042.50 levels.

If at all Bakkt functions as intended, they can ensure the safeguarding trading mechanism for the institutional investors, well-organized marketplace to trade Bitcoin. Thereby, the exchange could assist the apprehensions on the credibility that have hindered the pioneer cryptocurrency ‘Bitcoin’ from its prosperity by giving the digital-asset the considerable boost in authenticity.

While the price action of the underlying instrument which is ‘bitcoin’ is trading on a weaker side.

Technically, bears are on table nudging prices below 7 & 21-DMAs upon hanging man formation at $10,271.53 level, while both leading oscillators are bearish bias and the lagging indicators appear to be indecisive.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge