This year, crypto-derivatives space has established a remarkable milestone. Quite a few renowned exchanges have witnessed record volumes. While the OTC (Over-the-counter) trading desks are also coming up with new arrangements for crypto-derivatives.

The regulated bitcoin derivatives product volumes are still dominated by CME, whose total trading volumes are down 18.3% from August at 4.82 billion USD.

We’ve already emphasized in our recent posts that the summer peaks in bitcoin prices coincided with overbought conditions in both CME and BitMEX futures contracts.

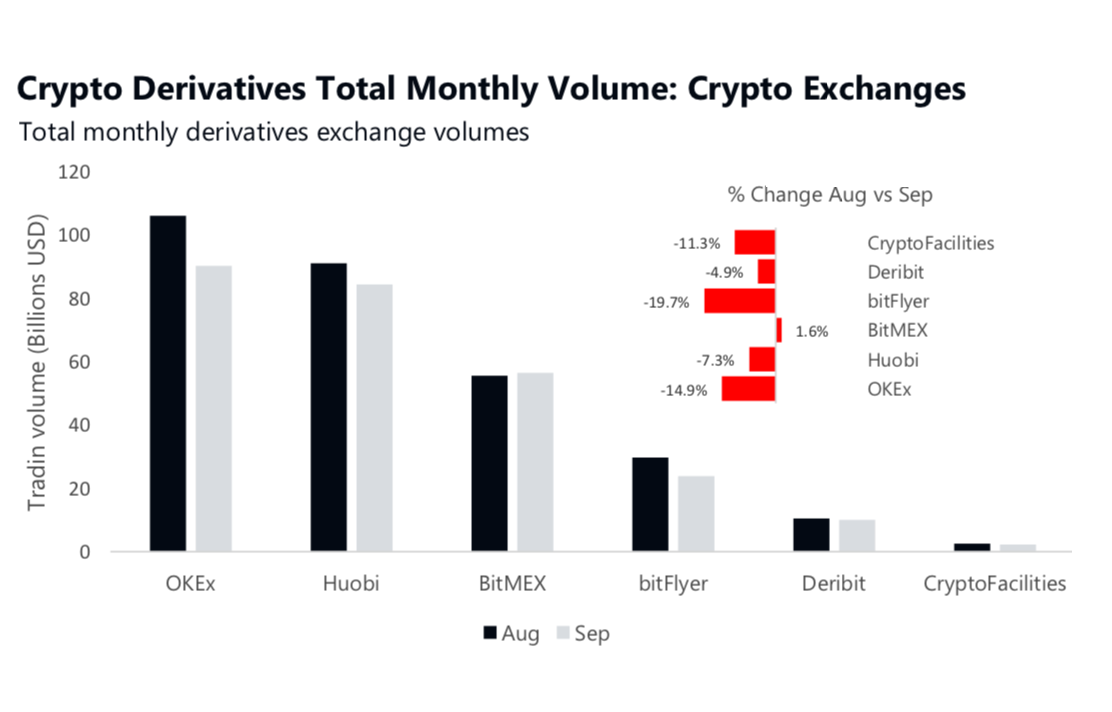

CryptoCompare’s Exchange Review is conducted on a monthly basis and caters to both the crypto-enthusiast interested in a broad overview of the crypto exchange market, as well as investors, analysts and regulators interested in more specific analyses. Wherein, OKEx was the top derivatives exchange in September, trading a total of 90.34 billion USD (down 14.9% from August). This was followed by Huobi with trading at 84.52 billion USD (down 7.3% from August). In terms of perpetual BTC futures products, BitMEX represent most of the market volume, trading totals of $41.7 Bln.

For now, OKEx’s derivatives desk offers perpetual swap and futures for cryptocurrencies. We’ve noted that the true level of institutional participation was likely greater than widely used trading volume figures implied, as a number of sources suggested that only around 5% of reported trading volume aggregated across cryptocurrency exchanges was genuine.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close