Bitcoin’s bullish streaks have parked at $9,857 level, currently flirting with price band between $9,728 - $10k areas. We had explicitly traced our bullish indication and advocated long build-ups on December 2nd. Ever since then, it’s been 53% price jump so far and 35% in 2020. The pair rallied from $6430 (Dec. lows, that is when we recommended fresh long build-ups) to recent highs of $9,857 level.

Refer below weblink for further reading on that:

Amid such uptrend, Bakkt’s total volumes and open interest of monthly BTC futures contracts of February deliveries have risen to 988 contracts and $13 million respectively to surpass its previous record high of $12 million.

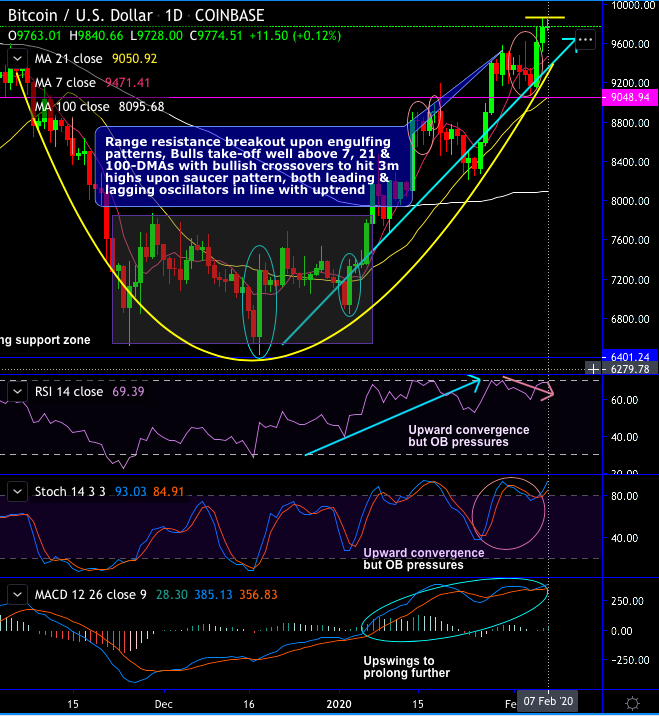

Technically, we traced out BTCUSD price at Coinbase, has broken out the range resistance upon bullish engulfing patterns. Despite some minor hiccups signalled by hanging man & shooting star patterns, the minor uptrend seems to be quite healthy for now upon saucer formation (refer daily chart). Bulls are now shrugging-off these bearish patterns and taking-off well above 7, 21 & 100-DMAs with bullish crossovers.

Both the leading and lagging oscillators are in line with the uptrend, though momentum oscillators (RSI & stochastic curves) signal the mild overbought indications.

On a broader perspective, the pair has bounced from $3,128 levels to $13,880 levels in the recent past, but paired gains in the H2'2019.

As we had foreseen the upside risks in the underlying security price upfront up to the retest of $13k mark again and advocated long hedges & trading strategies accordingly using CME BTC Futures, though the bearish pattern candles are popping-up in the minor uptrend coupled with the overbought pressures signalled by the momentum oscillators, we still perceive this as a better entry levels provided by the bears for fresh trades at this juncture.

The underlying price rally has now parked, those who want to take-off above $10k mark and fly towards $13k mark in the months to come, we recommend to uphold the above strategy by rolling over CME BTC Futures contracts of March deliveries on hedging grounds. Please be noted that on a fresh long build-up (rising price) coupled with the rising open interest and rising volumes is conducive factor from the contract holders’ perspectives. Courtesy: Tradingview, Bakkt & skew

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts