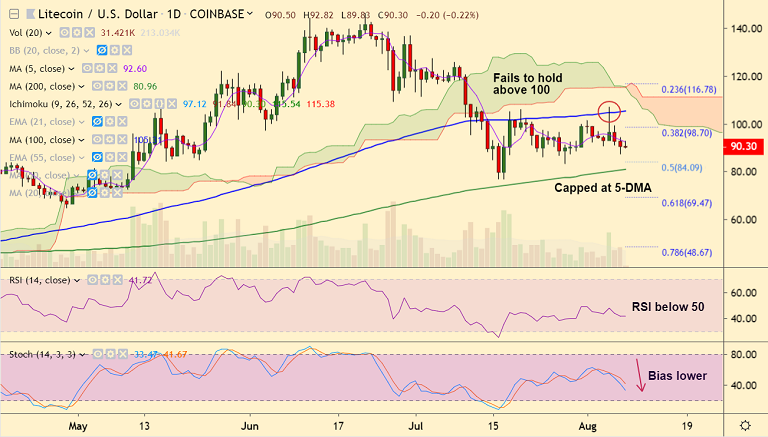

LTC/USD chart - Trading View

Exchange - Coinbase

Support: 86.87 (Lower BB); Resistance: 95.33 (21-EMA)

Technical Analysis: Bias Bearish

Litecoin is extending weakness after the much hyped 'Halving' event earlier this week.

LTC/USD has slipped lower for 2 consecutive days and is likely to extend weakness as indicated by technical studies.

Recovery in the pair has been rejected at session highs at 95.82, finds immediate resistance at 20-DMA at 93.84.

Major and minor trend remain bearish as indicated by GMMA indicator. Stochs and RSI have turned lower.

Resumption of downside will see test of 50% Fib retracement at 84.09 ahead of 200-DMA at 80.96.

5-DMA is immediate resistance at 92.61. Break above 100-DMA at 105.31 required for upside continuation.