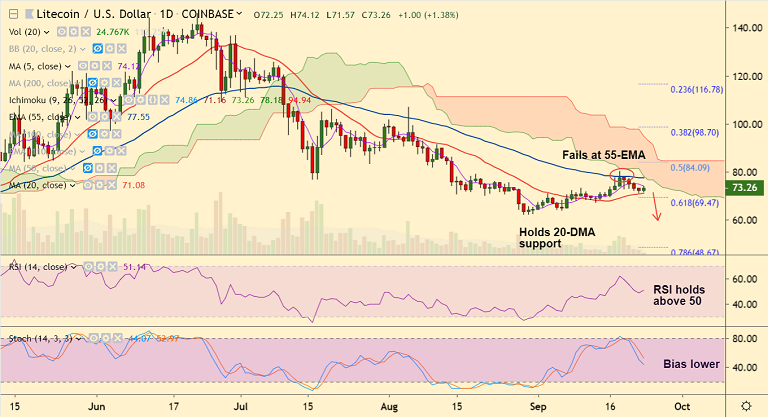

LTC/USD chart - Trading View

Exchange - Coinbase

Support: 71.08 (20-DMA); Resistance: 77.55 (55-EMA)

Technical Analysis: Bias Bearish

LTC/USD fails to break above 55-EMA, slips lower from 5-week highs at 80.26.

The pair has on the day stalled downside after 4 straight sessions of weakness.

Price was marginally higher at the time of writing, at 73.23, up 1.34% at 10:30 GMT.

Major trend in the pair has been bearish and rejection at 55-EMA has reinforced downside.

Price action currently finds support at 20-DMA at 71.08. Break below will see extension of weakness.

Bullish divergence could limit downside. Dip till 62.05 (Aug 29 low) likely. Further weakness will see downside till 48.67 (78.6% Fib).

On the flipside, breakout at 55-EMA and into daily cloud will negate near-term bearishness.