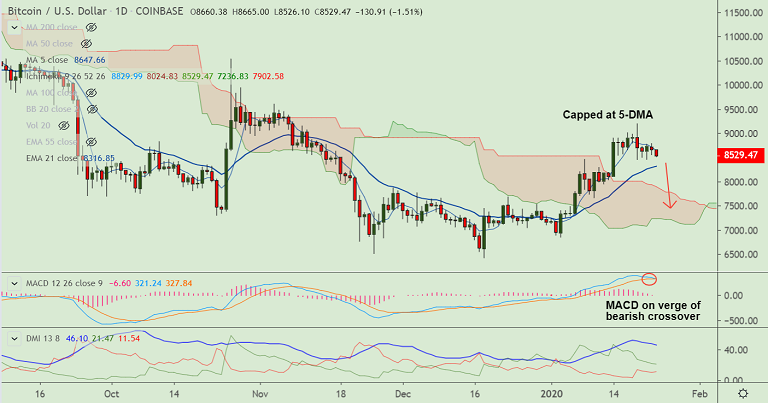

BTC/USD chart - Trading View

Exchange - Coinbase

Technical Analysis: Bias Bearish

GMMA Indicator: Major Trend - Bullish; Minor Trend - Turning bearish

Overbought/ Oversold Index: Neutral, Oscillators biased lower

Volatility: High, Shrinking

Support: 8318 (21-EMA); Resistance: 8650 (5-DMA)

BTC/USD extends weakness below 8600, intraday bias has turned bearish.

The pair was trading 1.25% lower on the day at 8554 at around 04:55 GMT, after closing 0.71% lower in the previous session.

Price action is on track to retrace back into slopping channel pattern and is eyeing 21-EMA support at 8318.

Stochs, RSI and 5-DMA are biased lower. MACD is on verge of bearish crossover on signal line.

Breach at 21-EMA support will add further bearish pressure, Dip till 55-EMA at 7993 then likely.

On the flipside, 5-DMA is immediate resistance at 8650. Break above 200-DMA (8988) required for upside continuation.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary