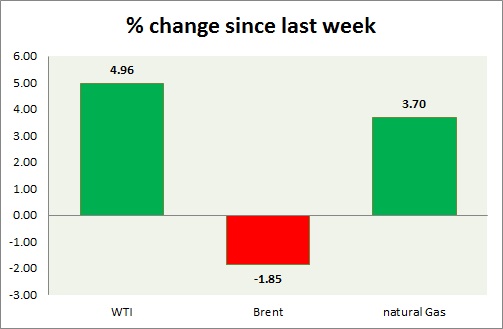

The energy segment over the last year remained the worst performer. Performance this week at a glance in chart & table -

- Oil (WTI) - Crude oil continue to trade between short ranges unimpressed by the comments of FED chair Janet Yellen so far. Dollar was weak across board, but crude turned out to be even weaker. Today's inventory data to be released at 15:30 GMT. Focus will be on total stocks as well as change in rigs in response to lower price. WTI is currently trading at $49.1/ barrel, down 0.25% for the day. Immediate support lies at 48 and resistance at 54.

- Oil (Brent) - WTI remains the worst performer in the segment. Brent-WTI spread is doing worse than yesterday trying to close above $10. Brent is currently trading at $59.1/barrel, up 0.99% for the day. Immediate support lies at 58 & resistance at 63.

- Natural Gas - Natural gas price is lacking volatility which could change in tomorrow's inventory report. Natural gas is currently trading at $ 2.92/mmbtu. Immediate support lies at 2.77 & resistance at 3.03.

|

WTI |

-3.35% |

|

Brent |

-1.55% |

|

Natural Gas |

-1.08% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand