MXN should decouple from the rest of the region from Q1 assuming growth is strong enough to allow Banxico to tighten credibly alongside the Fed.

ARS will almost certainly be devalued under the incoming Macri administration given Argentina's low reserve cover, but the move should be less than the forward given prospects for more a more constructive policy mix post-Kirchner.

COP could appreciate from mid-2016 if our recent crude oil stance materializes, but CLP probably depreciates through Q4 as copper prices test $4000/tonne.

BRL should continue to suffer from the 2015 cocktail of stagflation, fiscal slippage/credit risk and political uncertainty, even if each of these might diminish slightly in 2016.

The current account could fall to -2.1% of GDP from 4.5%this year, but the broader context still suggest to us greater depreciation than the forwards.

Oil-sensitive currencies have a better chance of rebounding than (mostly Asian) ones dependent on stronger Chinese demand.

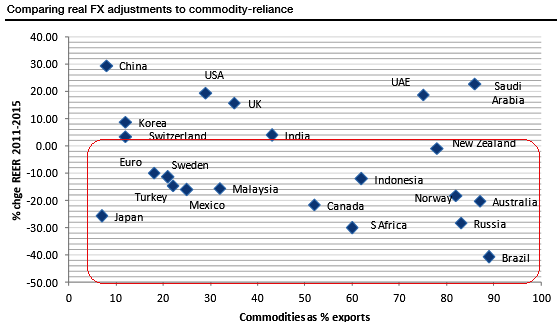

The above chart compares moves in real effective exchange rates since the peak of the commodity cycle in 2011 with the percentage share of commodities in the exports of the various countries. It's not worth putting a best-fit line through this chart, but it does show that a country like Brazil, with its really high reliance on commodity exports, has seen the biggest fall in its currency versus other major EM currencies.

Q1 end targets -USD/MXN should hold current gains 19.10 inching up towards 19.50, USD/BRL should bounce back again to 4.25 levels, same is the case with USD/CLP, rebounds upto 730 is pretty much on the table & USD/ARS should also to creep up 14.35).

Commodity prices and macroeconomic factors to weigh on under-stressed Latino FX space, likely to depreciate further

Thursday, February 11, 2016 1:23 PM UTC

Editor's Picks

- Market Data

Most Popular

5

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary