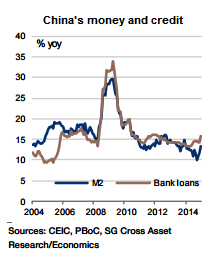

China's money and credit data for August are likely to have normalised lower in August, after the surprisingly strong readings in July given stock-market rescue measures.

"M2 growth is expected to have moderated to 12.6% yoy in August from the surprisingly strong rate of 13.3% yoy in July. New bank lending likely dropped to CNY1000bn, from CNY1,480bn in July", estimates Societe Generale.

Considering the CNY400bn LGBs issued under the debt-swap programme in August, the actual increase in bank loans was probably close to CNY1.4trn. Part of it should have been continued support to financial institutions' stock market rescue action, added Societe Generale.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed