Today Chinese property market data was released that showed signs of stabilization in Chinese housing market.

Chinese property market slowdown has already caused havoc for the economy, now if that market truly stabilizes that is very encouraging and positive news for the Chinese economy.

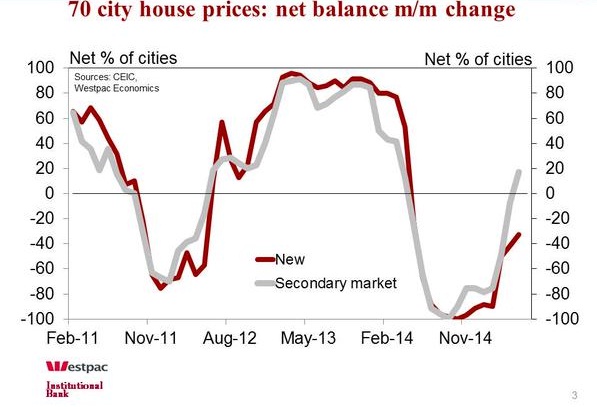

- Property price rises have been falling steadily from their peak in 2013 and by 2014 price growth has moved into negative territory.

- However, in 2015 prices have started bouncing back sharply at a time when foreign investments, foreign portfolio inflows are drying down. Prices are not only bouncing back but growing faster than the peak of 2013. As per latest data in Tier 1 cities second hand house prices are rising at 4% m/m and new residential at 3%.

While the above fact is very encouraging, it pose doubts that it might be speculative activity and government intervention than actual recovery.

- Prices are still subdued in Tier 2 and Tier 3 cities, suggesting the price jump in tier 1 could be due to speculative activity similar like stock market in China.

- Moreover land purchase by housing developers remain lower than as much -30% from a year ago.

Nevertheless investors should keep an eye in Chinese housing market to watch whether this turns out as speculation or beginning of recovery.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings