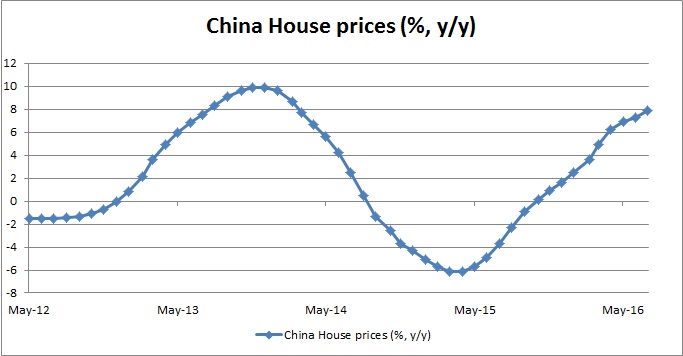

According to the data from China’s National Bureau of Statistics (NBS), the prices for new residential homes rose by 7.9 percent in July from a year back. Prices rose in 58 out of 70 cities surveyed on a yearly basis and declined in 11 of them. In June prices rose in 57 cities on a yearly basis. So there have been improvements. On a monthly basis, prices rose in 51 cities and declined in 16 of them. Overall growth is up from 7.3 percent registered in June.

However, the growth wasn’t broad-based. It is driven by first and second tier cities. Shenzhen topped the list again with 41 percent y/y growth, followed by Nanjing (34 percent), Xiamen (33.9 percent), Hefei (33 percent), Shanghai (27.3 percent), and Beijing (20.3 percent). This spectacular yearly statistics, however, hides monthly slowdown. Prices growth slowed down markedly in the majority of the cities.

Data released last week showed that the sales and investment in real estate have started to a slowdown. Real estate sales totaled Rmb5.7 trillion ($857.9 billion) during the January-July period, a deceleration of 2.3 percentage points for year-to-date growth from a month earlier to 39.8 percent. Annualized growth in real estate investment YTD came in at 5.3 percent in July, down from a peak of 7.2 percent in April.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off