Sudden change in China's exchange rate mechanism earlier this week rattled markets across the globe. It is definitely not a panicked change towards 'growth-through-devaluation' strategy. The PBoC had been preparing for a more market-oriented exchange rate mechanism for some time.

Following a stock market sell-off and increasing fear of a looming financial crisis, the PBoC announced a symmetric 25bp benchmark rate cut on Tuesday, combined with a 50bp RRR cut, while at the same time also removed the ceiling on interest rates for term deposits with maturities greater than one year.

This is the second such combined cut, after a similar move on 27 June. The move comes after some rapid deterioration in the Q3 data and equity market turmoil. Stabilising growth and channelling low cost financing to the real economy remain the top priority for monetary policy in H2 2015. Hence, still-elevated interest rates and tighter onshore liquidity justify the rate and RRR cuts.

"DB's Chief China Economist, Zhiwei Zhang saw the cuts as broadly in line with his expectations, but of more surprise to Zhiwei was that the cuts took place yesterday evening rather than over the past two weekends. Zhiwei continues to forecast for another RRR cut this year (and biased towards Q4) but no further cut to the benchmark interest rate".

Asian shares struggled on Wednesday as investors feared fresh rate cuts would not be enough to stabilise China's slowing economy or end a collapse in Chinese stocks that is wreaking havoc in global markets. the move failed to shore up battered Shanghai shares, the Shanghai Composite Index was down 2.3 percent on Wednesday. Another choppy trading session continued for the antipodeans, with sentiment remaining brittle amid concerns over China's economy.

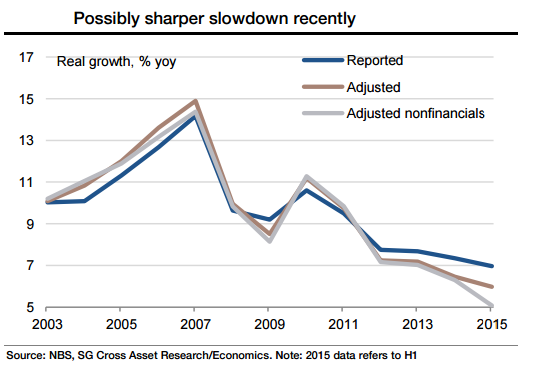

Domestic headwinds from excess capacity in many industries, oversupply in the housing market, high debt/GDP, as well as uncertain external demand continue to weigh on the Chinese economy. While the government still has room to ease on the monetary and fiscal front, fiscal stimulus comes at a cost of worsening the debt burden and economic imbalance, while the boost from interest rate cuts to economic growth is limited given the ineffective monetary transmission and interest rate liberalisation.

"We expect Tuesday's PBoC move to help support sentiment and economic growth in Q4, though the risks to our forecasts of 6.8% in 2015 and 6.6% in 2016 will remain to the downside." said Barclays Capital in a note to its clients.

As we write, European indices have resumed their sell-off after yesterday's recovery. Germany's DAX 30 drops -1.31% to 9995 while the UK benchmark FTSE 100 loses -1.45% to trade at 5993. The French CAC 40 index is down nearly -1.50% and trades at 4497, and the pan-European Euro Stoxx 50 also slips -1.6% to 3,166.

China's growth to remain subdued through 2016, more easing cannot be ruled out

Wednesday, August 26, 2015 11:13 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?