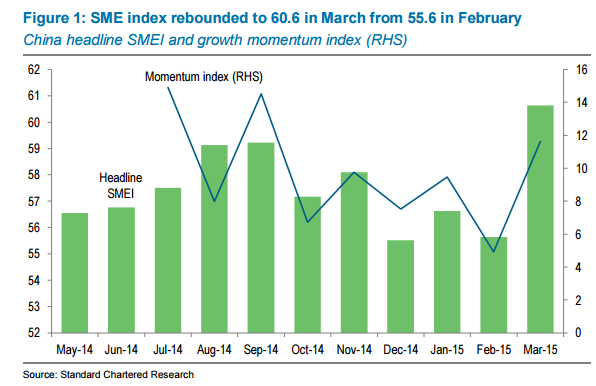

The China's SMEI current performance index rebounded to 58.0 in March from 52.8 in February. Importantly, nearly all performance indicators improved.

The key sub-indices for production and new orders strengthened to 61.2 and 64.2 in March, respectively, from 54.4 and 54.1 in February. This suggests a rebound in real activity during the month. The latest survey points to a pick-up in production after the Lunar New Year holidays, though it is still below Q3-2014 levels.

"New orders, however, rose to the highest level since our survey started in May 2014. This bodes well for production in the coming months," says Standard Chartered.

The two forward-looking sub-indices, investment and raw-material inventories, also improved in March. The investment sub-index edged up to 55.6 from 53.3, and the raw-materials inventories sub-index rose 7.5 points to a record high of 58.2. This suggests that manufacturers are starting to restock in anticipation of rising business activity in the coming months.

Labour-market conditions have improved, albeit marginally. The employment subindex rose to 54.4 in March from a low of 50.0 in February. This suggests that hiring has picked up after the holiday season, but the labour market remains generally soft. The salary sub-index moderated to 63.8 in March from a record high of 66.9 in February; this provides little comfort for SMEs, as labour costs remain high. On the positive side, the employment expectations sub-index rose significantly in March, indicating an increase in hiring demand in the near future.

China's SME activity appears to have warmed up after the holiday season

Monday, March 30, 2015 5:34 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022