China’s monetary data released on Wednesday were generally weak, in line with soft economic activities. Aggregate financing was 659.9 billion yuan in May, down from 751 billion yuan in April and below the median for 1 trillion yuan, as short-term bill financing slumped and net issuance of corporate bonds turned negative. However, new yuan loans rebounded to 985.5 billion yuan ($150 billion) in May, up from a six-month low of 556 billion yuan in April and beating expectations for a climb to 750 billion yuan.

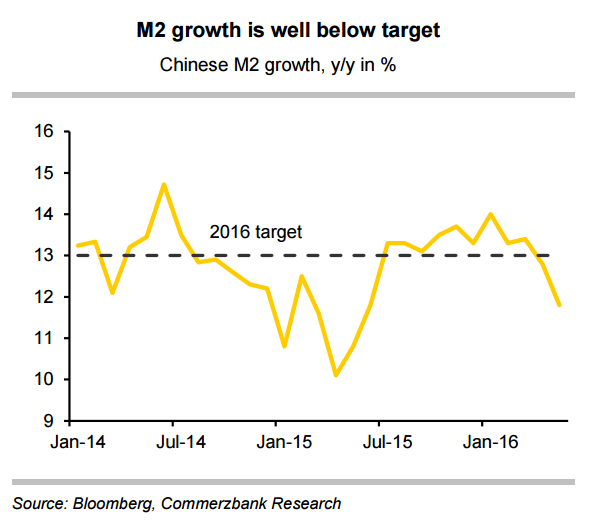

Broad M2 money supply (M2) grew 11.8 percent from a year earlier, down from April's 12.8 percent. Analysts had expected May growth of 12.5 percent. Outstanding yuan loans grew 14.4 percent by month-end on an annual basis, versus expectations of 14.2 percent. The PBOC is targeting annual M2 growth of around 13 percent this year, and with M2 growth running well below its 13 percent target, authorities are likely to add more easing measures in the foreseeable future.

"Higher-than-expected loan for May will reinforce our view that the PBoC will not choose to stimulate massive loan growth. Their monetary policy stance will still be moderately accommodative. In order to achieve the M2 target of 13%, we continue to pencil in one more RRR cut of 50bps for the remainder of 2016." said ANZ research in a report.

Today’s monetary numbers, plus the activity data released earlier this week, illustrated a worsening downward trend and clearly point to downside risks to economic growth. The International Monetary Fund this week said China’s near-term economic outlook is being buoyed by policy support, however, noted that China’s corporate debt is high and rising fast. IMF deputy MD Lipton called on the authorities to speed up financial reform in order to head off the risk of systemic shock.

The government is trying to recalibrate the economy towards consumer demand in order to achieve a 6.5% growth target in 2017, down from 6.9% last year. But sky-high government and corporate debt levels and real estate glut loom on the horizon and threaten the economy's foundations. The economy has shown some signs of steadying in recent months but recovery remains uneven.

"As growth momentum continues to slow, and inflation remains soft, we think that further monetary easing will inevitably follow. We hold on to our view that the PBoC will either cut the RRR by 50bps or cut the policy rates by 25bps this month." said Commerzbank in a report.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand