China has launched an antitrust investigation into Alibaba Group as part of an accelerating crackdown on anticompetitive behavior in China’s internet space.

It will summon the tech giant’s Ant Group affiliate for a meeting.

Last month, China suspended Ant’s planned $37 billion initial public offerings, two days before shares will begin trading in Shanghai and Hong Kong. The IPO was on track to be the world’s largest.

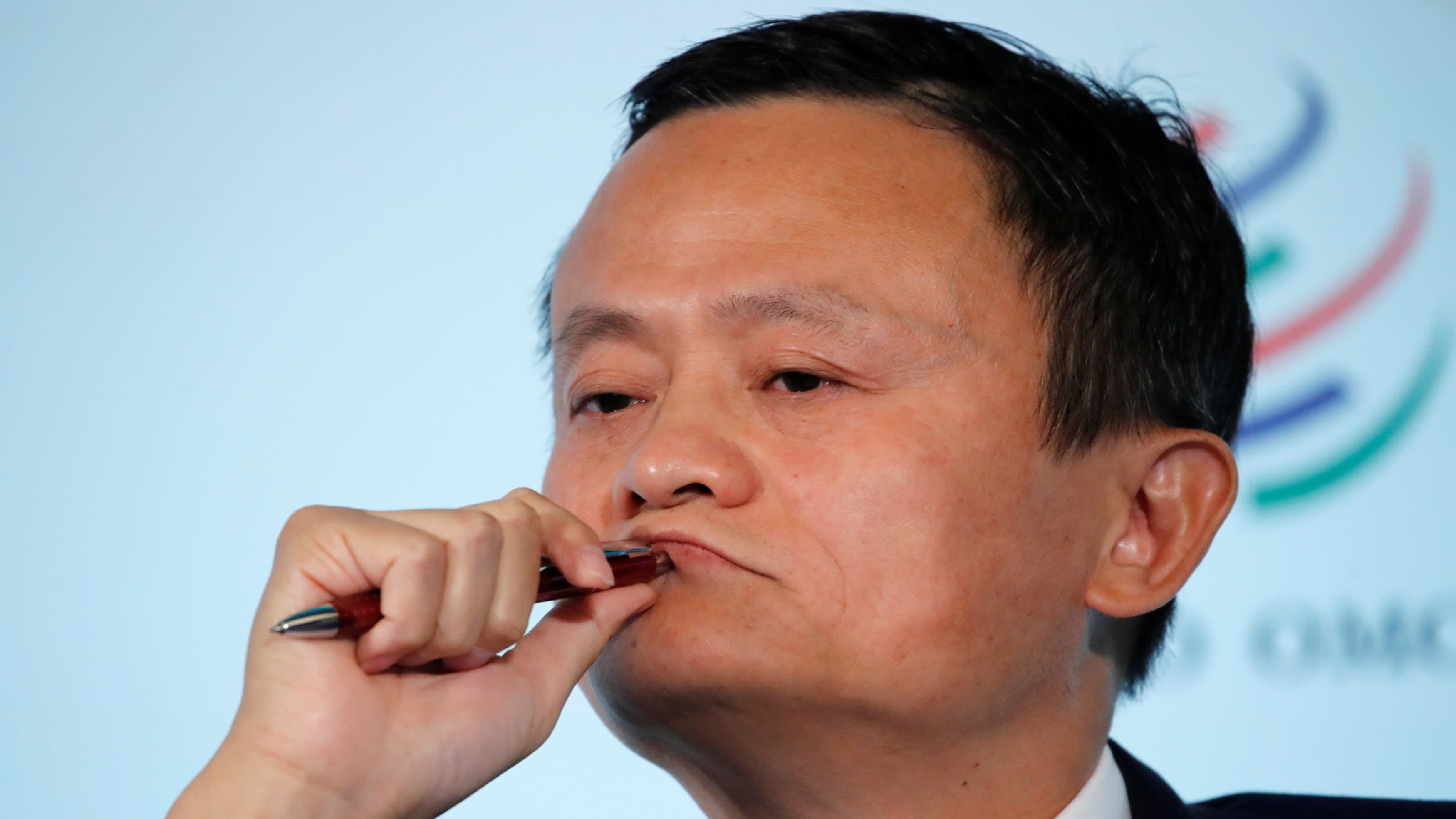

The suspension follows Ant Group founder Jack Ma's criticism in a speech during a forum in Shanghai of China’s regulatory system, accusing it of stifling innovation.

The Communist Party through its editorial published in People’s Daily said that it would not tolerate monopoly and for companies to expand in a disorderly and barbarian manner to allow the industry to develop in a healthy, and sustainable way.

Alibaba shares plunged nearly 9 percent in Hong Kong, their lowest since July, while rivals JD.com and Meituan and JD.com both dropped by over 2 percent.

The State Administration for Market Regulation (SAMR) said on Thursday that it had launched a probe into Alibaba's practice of requiring merchants to sign exclusive cooperation pacts preventing them from selling on rival platforms.

Financial regulators will also meet with Alibaba’s Ant Group fintech arm in the coming days to guide Ant Group in implementing financial supervision, fair competition, and protect the legitimate rights and interests of consumers.

Ant said it would “comply with all regulatory requirements” and that it would cooperate with the investigation. It claimed that operations remained normal.

Fred Hu, chairman of Primavera Capital Group in Hong Kong, and Ant investor said that global markets would observe whether the moves were “politically motivated” and targeting successful private tech companies only.”

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning