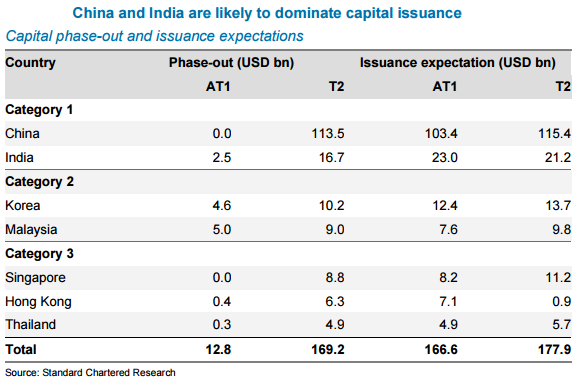

In terms of ongoing capital requirements, the banks are divided into the three broad categories as High capital requirement, Moderate capital requirement and Low capital requirement.

Standard Chartered Bank notes in a report on Wednesday:

- High capital requirement category comprises banks/banking systems with relatively strong credit growthand modest current capital levels. China and India banks fall into this category.

They will need to raise both AT1 and T2 from the capital markets to meet their Tier 1 (T1) and total capital requirement.

Given their relatively weaker capital accretion relative to growth, these banks may prefer to maximise AT1 to boost total T1 capital ratios. Thus, capital issuance from these banks will likely be heavy. - Moderate capital requirement category includes banks/banking systems whose current capital levels are not high and whose capital accretion is modest, but whose credit growth is also modest, leading to moderate incremental capital requirements.

- Low capital requirement category is made up of banks or banking systems whose current capital levels are quite high and whose capital accretion is reasonable, and banks that have a propensity to maintain high capital levels.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022