China is set to introduce new guidelines promoting open-source RISC-V chip adoption, aiming to lessen reliance on Western semiconductor technology, according to Reuters. The policy, expected as early as this month, is being developed by eight government agencies, including the Cyberspace Administration of China and the Ministry of Industry and Information Technology. However, the timeline remains flexible.

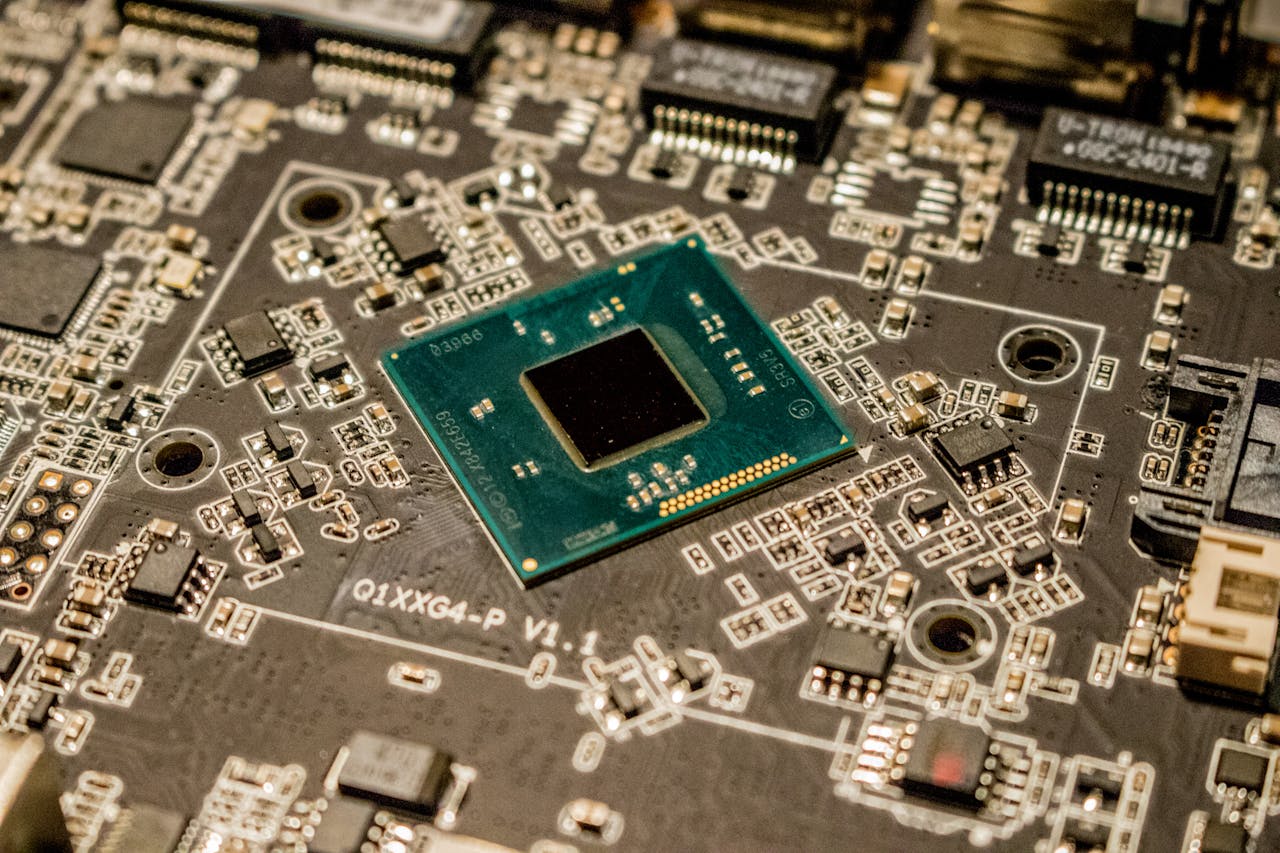

RISC-V chips provide a cost-effective, customizable alternative to proprietary processors like Intel’s x86 and Arm Holdings' architectures. As an open-source technology, RISC-V enables companies to design specialized chips for applications ranging from smartphones to artificial intelligence and supercomputers.

Chinese firms are increasingly embracing RISC-V for its affordability and geopolitical neutrality. State-backed research institutions have been exploring the technology, though Beijing has yet to officially prioritize it. The push comes amid rising U.S.-China tensions over semiconductors, with Washington imposing restrictions on China’s access to advanced chips. Some U.S. lawmakers have even suggested limiting American firms’ collaboration on RISC-V due to national security concerns.

China’s major RISC-V players include Alibaba and Nuclei System Technology. If the upcoming policy accelerates adoption, it could bolster China’s domestic semiconductor ecosystem, reducing reliance on U.S. chip giants like Intel (NASDAQ:INTC) and AMD (NASDAQ:AMD).

With geopolitical risks and trade restrictions shaping the global chip landscape, China’s move toward RISC-V signals a strategic effort to foster homegrown innovation and ensure technological self-sufficiency.

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering