China Caixin PMI flash reading started off a fresh round of panic selling in Asian market as headline PMI slowed to 47, lowest level in 78 months. Output dropped similar to 45.7 in September, again 78 months low.

One should note that, flash PMI presents closest estimate of final PMI as it is based on 85-90% of the respondents but final can be a bit different.

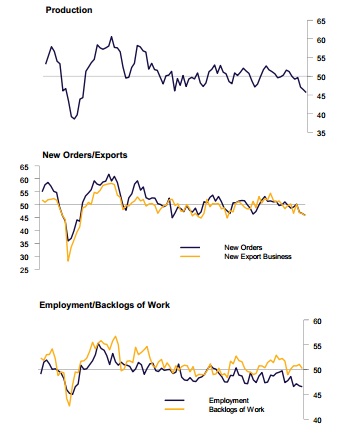

Based on the PMI report it would be fair to say that further weakness is likely as all the sub-indices such as new orders, new export orders, employment, output and input prices, stocks and quantity of purchases, decreasing at faster rate.

In spite of weakness, Caixin's chief economist sights structural reform and effects of external demand and prices.

Commentary indicates that Chinese government might have started its stimulus program as fiscal expenditure increased in August.

Focus now will be on both monetary and fiscal policies as Chinese government tries to reverse course of ailing economy.

China's benchmark stock index, Shanghai Composite is currently trading at 3136, down -1.5% for the day.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary