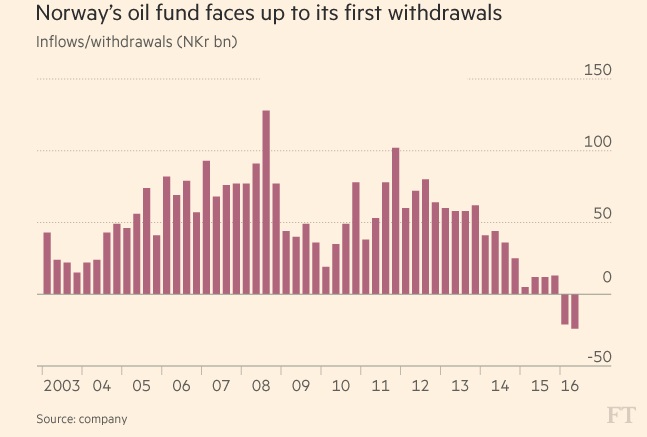

According to the latest report from Norway's sovereign wealth fund (SWF), available here, https://www.nbim.no/en/transparency/reports/2016/2q-2016-quarterly-report/ , the government has withdrawn money from its enormous NOK7.3 trillion corpus. In the first quarter, the government withdrew for the first time in more than two decades and that NOK 21 billion. And again in the second quarter, it has withdrawn NOK24 billion. The government is expected to withdraw another NOK 40 billion by the end of this year.

The amount, that has been withdrawn so far ($5.5 billion), is very small compared to the fund size ($890 billion), but large enough to raise eyebrows in the financial market, especially if the trend persists.

Chart courtesy: Financial Times

You can see the story covered in detail in Financial Times, here, https://www.ft.com/content/2638845e-648b-11e6-8310-ecf0bddad227

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off