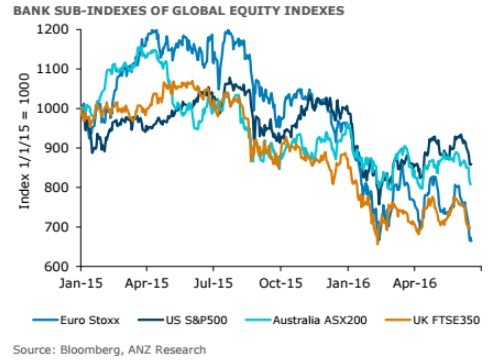

Negative rates eating into the banks' return, banks overexposure to weaker commodities' segment, regulatory curbs, billions of dollars of fines and now add the possibility of turmoil in the financial capital of the world London in the mix and you have perfect doom recipe for the sector.

Even in the European Central Bank's corporate security purchases, the ones from the banks are not included.

No wonder banks are hammered.

Will all these lead to higher funding cost for them?

Chart courtesy: Sharon Zöllner, ANZ research

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed