CAD/JPY pared some of its gains after weak Canadian jobs data. It hits an intraday high of 107.69 and is currently trading around 107.428.

Canada lost 40,800 jobs in July 2025—mostly full-time positions in the private sector—which was its greatest monthly job loss since the COVID-19 crisis; meanwhile, the national unemployment rate remained steady at a multi-year high of 6.9%. With 34,000 jobs lost, youngsters aged 15 to 24 were disproportionately impacted, hence driving their jobless rate to 14.6%, the highest since 2010 outside of the epidemic. Though manufacturing showed little gains, major job losses were noted in the information, culture, entertainment, and construction industries. Following a particularly strong June, this contraction implies a weakening labor market that could help the Bank of Canada's future interest rate reduction, therefore emphasizing the ongoing problems experienced by younger workers even in generally steady unemployment.

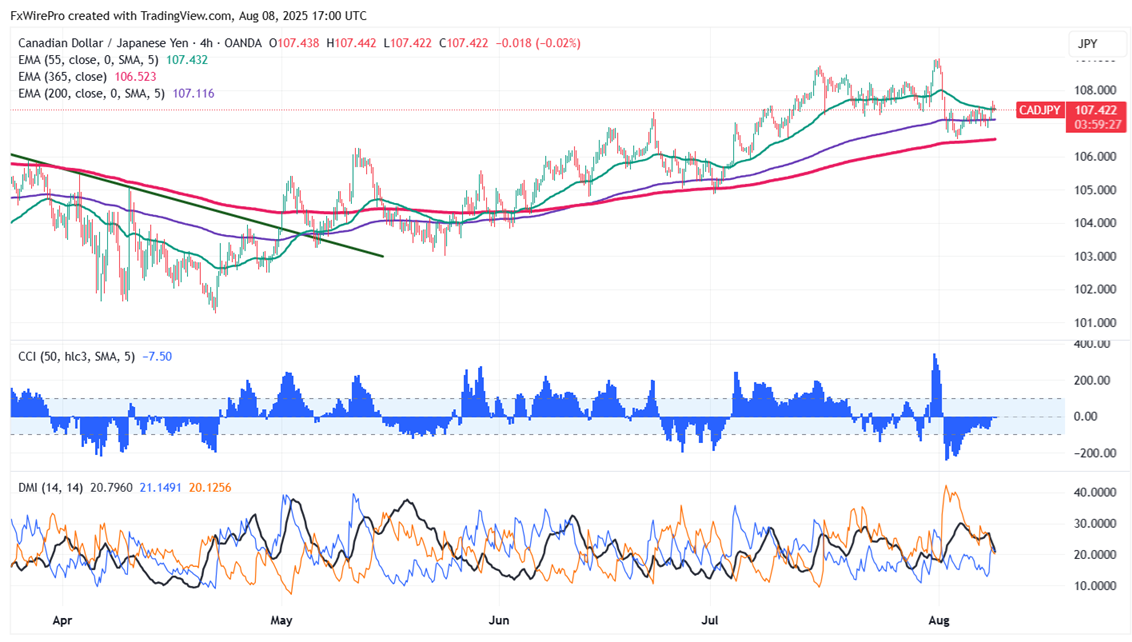

Technical Analysis

CAD/JPY is currently trading above the 34- and 55-EMA on the 4-hour chart. The immediate resistance is at 108.25; a breach above this level could shift targets to 108.75/109/110. On the lower side, near-term support is at 106.85,and a break below this support could lead to declines toward 106.50/105.80/105/104.78/104.50/103.85/103/102.50/10.65/101/100.

Indicator Trends

CCI (50)- Neutral

ADX (14)- Neutral

Trading Strategy Recommendation

It is good to buy on dips around 107.45-48 with a stop-loss at 106.84 and a target price of 110.