As widely expected, the Bank of Canada kept its key policy interest rate unchanged at 0.5%, while upgrading their growth forecast relative to January forecasts, largely as a result of the 2016Q1 pop in growth.

The Canadian economy is now forecast to expand by 1.7% in 2016, a marked upgrade from January's outlook for 1.4% growth. The pace of expansion is expected to pick up further in 2017, reaching 2.3%, before slowing to 2.0% in 2018.

Yesterday’s BoC meeting demonstrated that the Canadian trade participants too are dejected about the potency of their currency. The stronger CAD could very well be understood with the recent rise of the crude prices, the consolidation stage is observed since the beginning of 2016, the more optimistic Bank of Canada (BoC) and the more cautious Fed.

Nevertheless, that is not suffice and does not change the fact that the stronger CAD is affecting the outlook for exports outside other commodity segments.

In fact the BoC might have lowered its outlook – thus no doubt causing speculation about a further easing of monetary policy – if the government had not counterbalanced the downside risks for the economy with a major economic programme.

However, that also means: in case of further appreciation the BoC projections are at risk. And that would hardly be CAD positive.

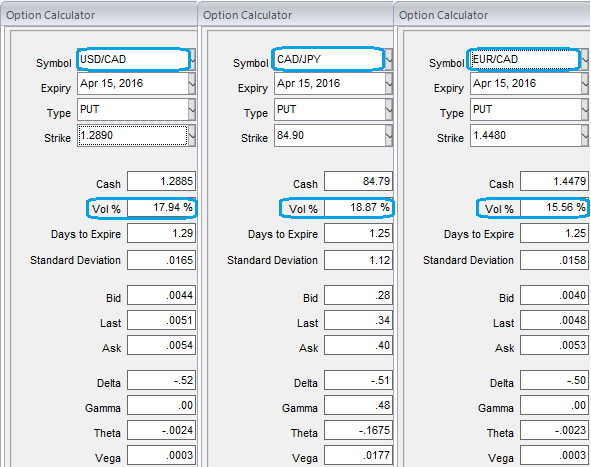

As a result, much noise in FX option markets for CAD crosses is observed. As you can probably make out from the above diagram all the CAD crosses have IVs spiking above 15% and above. We think this is just momentary but stay stabilized at around 12-13% in the days to come.

The put contracts with 50% deltas of these G7 pairs have been spiking owing to the yesterdays' BoC's monetary policy decision and data release ahead in this week. The data to look forward are US CPI and unemployment claims today during US session and Canadian manufacturing sales on Friday.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022