Lower oil price, Canada's most important export and source of revenue is leading to lower business investment in the country, which now stands at lowest since the great recession of 2008/09.

Lower oil price is having its contagion effect across industries. Lower oil price is lowering revenues for oil producing sectors, which in turn reducing their investments into new wells, hitting oil exploration and drilling sector. This sector again impacting heavy equipment manufacturing as well as oil services industry on the downside.

As a result, more jobs are being lost than gained. In December, Canadian unemployment rate picked up another 0.1% and reached 7.1%. Higher unemployment is also impacting overall spending in the economy, creating trouble for consumer goods industry as well.

As oil dropped further compared to 2015, contagion could further derail economy.

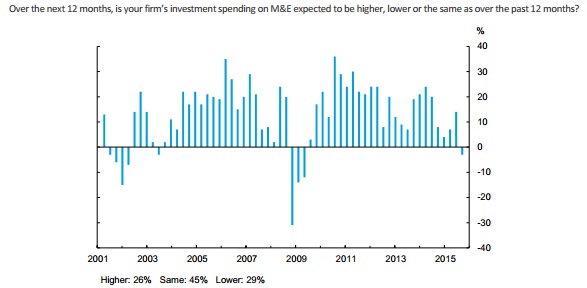

Latest Business condition survey of Bank of Canada show, overall investment intentions in the next 12 months has fallen to negative for first time since the crisis, as shown in figure. As per the survey, 45% of the company said their investments would remain same, while 26% expect it to rise and 29% to decline.

Canadian Dollar has been battered to lowest level in more than a decade, however gained sharply over last two days as Bank of Canada (BOC) kept policy unchanged and oil recovered post-ECB stimulus hint. This rally however, may not sustain if oil price remain weak. Loonie is currently trading at 1.426 per Dollar.

RBC capital market believes "Despite a short-term CAD rally after the BOC failed to cut rates at the January 20 meeting, we believe that the uptrend in USD/CAD will persist. The 1.5000 level now serves as an anchor for the market."

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure