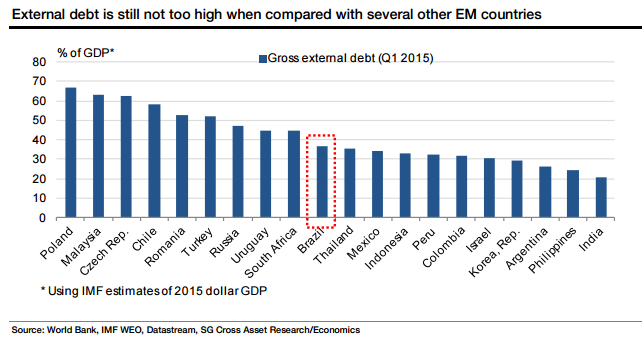

Brazil's external debt (ED) to GDP ratio - which declined to nearly 17% of GDP in 2008 and still stood at a moderate 25.2% at the end of 2013 - rose to 41% of GDP in Q3 15. While the increase in 2014 was driven by a rise in external borrowing, the recent increase in the ratio has been driven purely by the depreciation in the BRL that led to a contraction in dollar GDP. With the USD to BRL exchange rate expected to stay close to USD1= in Q4 15, the ED to GDP ratio is expected to rise to 45% of GDP this year.

Despite this significant increase, Brazil's ED to GDP ratio remains fairly comparable to that of most EM countries, including some Latam countries (Chile in particular). Furthermore, when looked at in isolation, it seems that the ED to GDP ratio itself is not all that threatening. Rather, it is Brazil's macro and financial situation that is responsible for the discomfort with the current level of ED to GDP ratio.

Brazil’s external debt is not among the worst in the EM world

Wednesday, September 30, 2015 8:53 PM UTC

Editor's Picks

- Market Data

Most Popular

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out