The Bank of Japan has kept monetary policy on hold at its meeting on 6-7 October, and maintained its overall economic assessment in the policy statement. The c.bank acknowledged risks from a slowdown in emerging markets but otherwise made little concession to recent weak data. The statement signals some genuine BoJ optimism in Japan's economy, reducing the chances of additional QQE at the end of this month.

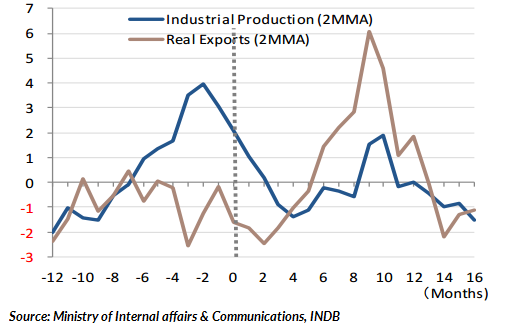

That said, the BoJ has been relatively slow compared to the Govt in revising down its assessment on the economy despite weak economic indicators. Skimming over some recent data, it is seen that August production was weak, declining for a second consecutive month, mainly due to the unstable export environment, especially to emerging economies including China. The latest Q3 BoJ Tankan survey confirmed that both manufacturers and non-manufacturers are cautious about Japan's business outlook.

Japanese government has already revised down its overall assessment on production, explaining that "Industrial Production has weakened", as opposed to "Industrial Production fluctuates indecisively" in the previous assessment. This implies that production is now weakening as a trend. The production data for September (to be announced on 29 October) is likely to show further weakness.

The BoJ is set to update its growth and inflation forecasts at the end of October meeting, with large downgrades widely expected, fueling expectations of additional QQE measures. The International Monetary Fund has also warned earlier this week that the central bank should ease monetary policy soon if it wants to hit Japan's inflation bull's-eye. However, the c.bank is likely to wait and see until end-October when the results from September economic indicators are released.

"The FY16 inflation projection will likely be revised down sharply from +1.9% and the central bank may finally admit that the 2% target will be difficult to achieve within the indicated time-frame. With regards to additional QQE measures, we expect the BoJ to increase the annual monetary base target to ¥85trn on an annual basis, up from ¥80trn, with the increase mainly directed at risk assets, including ETFs (about ¥3trn yen)", says Societe Generale in a research note.

Data today showed that Japan's machinery orders unexpectedly fell in August in a worrying indication that capital expenditure is weaker than many policymakers expected, which could increase the chances of new fiscal and monetary stimulus. Core machinery orders, a leading indicator of capital expenditure, fell 5.7 percent in August versus the median estimate for a 3.2 percent increase, and followed a 3.6 percent decline in the previous month.

USD/JPY extended the bearish momentum for a third straight session on Thursday. Nikkei dropped 0.99 pct to close at 18,141.17, triggering fresh demand for the yen. USD/JPY was trading at 119.80 and EUR/JPY was at 135.32 at 1010 GMT. Strong support for USD/JPY seen at 119.6O levels, breaks below could see the pair at 118.80 levels.

BoJ to wait-and-see until end-Oct for additional QQE measures

Thursday, October 8, 2015 10:35 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.