The BOJ's next policy meeting takes place March 14-15, and expectations are the central bank will keep key policy tools unchanged. On January 28, the Bank of Japan shocked the global markets by introducing negative interest rates and is unlikely to follow on so soon. Barclays Capital has pushed back its expectation of more BOJ easing until the July meeting.

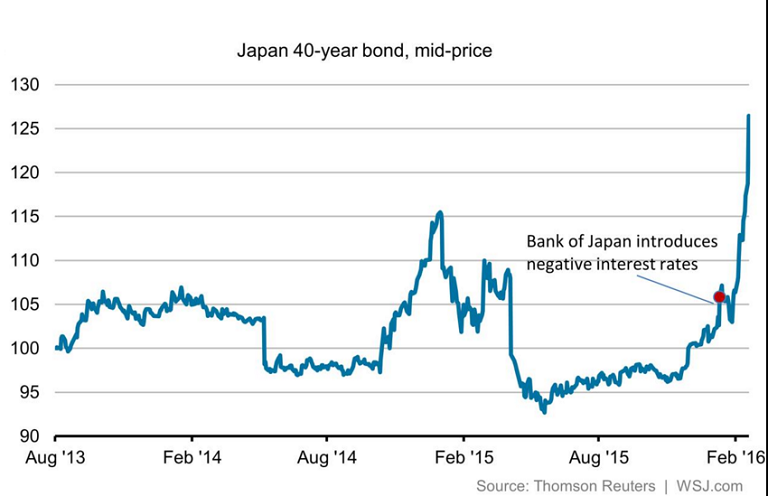

Negative rates introduced last month continues to dislocate and increasingly engulf the entire Japanese Government bond curve. Longer dated Japanese government bond yields declined to new depths on Tuesday, with the seven-, 10-, and 30-year benchmark yields all setting record lows. JGBs with maturities out to 11 years are currently trading with negative yields. The yen however has remained relatively stable at stronger levels over the past month and the BoJ is likely to find it increasingly difficult to re-weaken the yen through further monetary easing.

Recent economic developments in Japan are however continuing to place pressure on the BoJ to deliver further monetary easing ahead of the elections in the summer. Japanese economy is underperforming the BOJ's expectations. The bank projects the economy will contract at a seasonally adjusted annual rate of 0.1% in Q1 16, which is far lower than consensus at 1.4%.

The Japanese economy appears to have started the year on a weak footing following the contraction at the end of last year. The economy contracted at an annual rate of 1.4% in the final quarter of 2015. The BOJ needs more time to monitor the impact of negative rates on the behavior of financial institutions and the economy.

Japan's core CPI looks likely to "fall more steeply y/y toward June-July," and that the central bank is likely to lower its core CPI outlook in either the April or July review and push bank its forecast for arriving at its 2% target.

"Downside risks to the economy have become apparent. In addition to oil price falls, when the BOJ judges the disappearing effects from yen's weakness hampers price recovery, it will likely ease again," said Takeshi Minami, chief economist at Norinchukin Research Institute.

BoJ to stand pat at next week's meet, easing expectations pushed back until July

Wednesday, March 9, 2016 12:22 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook