Bitmain, one of the largest crypto mining hardware producers, is now worth $12 billion after a successful Series B funding of the company, Cointelegraph reported. The hardware manufacturer has gotten financial support from multiple entities, including from its long-time backer, Sequoia Capital.

The Series B funding managed to accumulate $300 million to $400 million, with the money coming from Sequoia Capital’s subsidiary, Sequoia China, U.S.-based Coatue hedge fund, and Singapore governmental investment fund EDBI. The amount is more than six times the funding it received back in 2017, when the company successfully raised $50 million in its Series A funding, with the monetary endowment coming from Sequoia Capital and IDG Capital.

Since Bitmain’s founding in 2013, the crypto mining hardware company has experienced enormous market growth in the industry. According to the firm itself, its 2017 profit was estimated to reach $2.5 billion from its core cryptocurrency mining business.

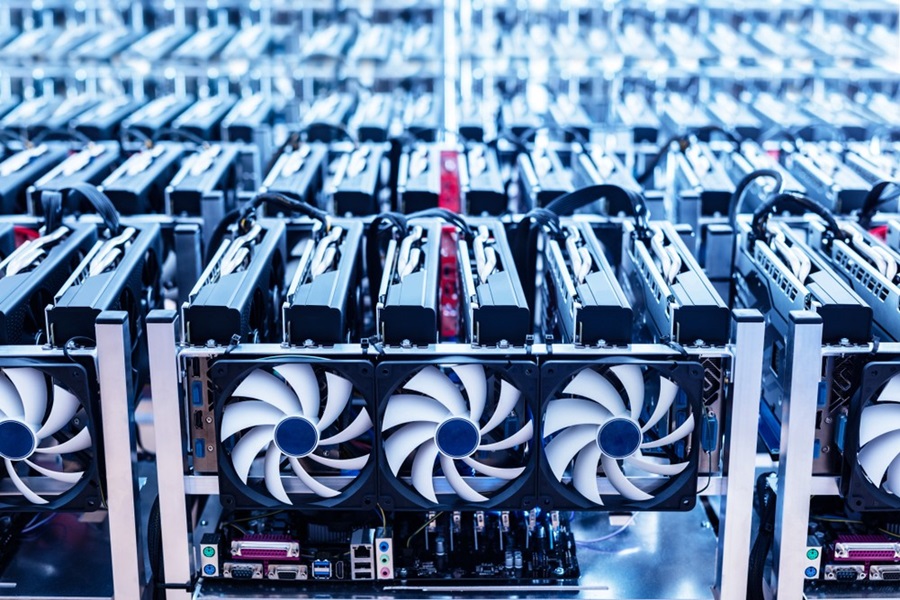

Moreover, Bitmain has also extended its reach beyond its original business model, expanding into other blockchain-related endeavors. The company owns two of the biggest Bitcoin (BTC) mining pools in the world, which are AntPool and BT.com. Aside from this, Bitmain also holds sway on the operations of ViaBTC, which is considered the third largest BTC mining pool globally.

For this reason, Bitmain controls nearly 51 percent of BTC’s mining hash rate. ViaBTC gives it 11.8 percent control, Antpool grants it 12.5 percent, and BTC.com provides 22.9 percent, totaling the hashing power to 47.2 percent.

Thus, with a little bit of a push, Bitmain can potentially manipulate the BTC network if it goes beyond 51 percent. However, the company already said that it has no intention to do such a thing. But others are skeptical, including the CEO of Ripple, Brad Garlinghouse, who said last month that BTC is mostly controlled by China.

“I’ll tell you another story that is underreported, but worth paying attention to. Bitcoin is really controlled by China. There are four miners in China that control over 50 percent of Bitcoin,” Garlinghouse claimed. “How do we know that China won’t intervene? How many countries want to use a Chinese-controlled currency? It’s just not going to happen.”

Of course, concrete evidence has yet to surface if this is indeed the case. As of now, Bitmain’s eyes are set on the acquisition of the initial public offering by internet browser Opera. Reports are saying that of the $115 million shares in the market, Bitmain will buy 43 percent of it, which is equal to $50 million.

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure