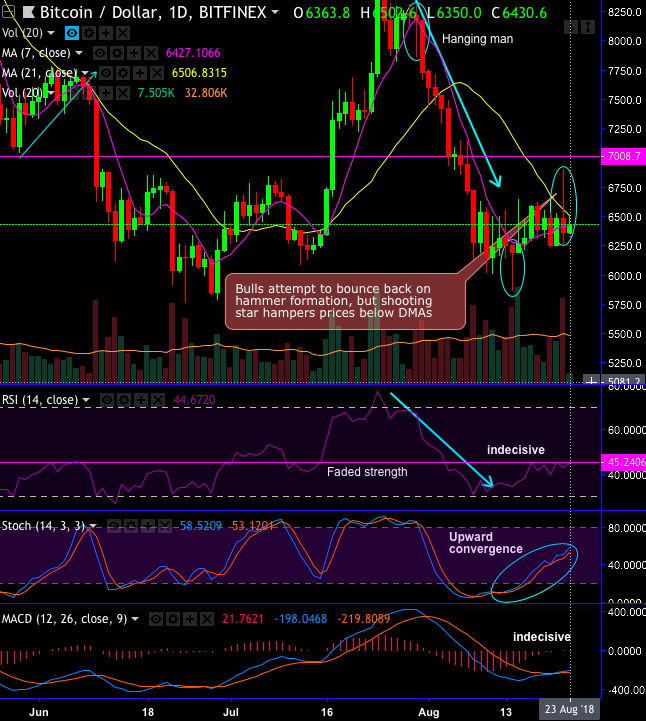

Today, although BTCUSD prices have attempted to bounce back from the lows of $6,350 levels to the recent highs of $6,502.6 levels, a sharp shooting star has occurred yesterday at $6,363.80 levels to signal bearish sentiment on the news of US SEC’s rejection of series of ETF proposals from three different companies.

ETF provider Direxion proposed to list and trade five bitcoin ETFs, while GraniteShares and ProShare presented two each, all of which were denied by the SEC at this juncture.

Well, on the flip side, while Lou Kerner, co-founder of CryptoOracle, which delivers cryptocurrency advisory services and functions a venture fund focusing on decentralized technologies, reckons that this crypto will render superior service over other asset class and most likely to occupy gold’s place as the top store of value, during the recent interview with CNBC. Gold, so far, has been the safe haven and the global store of value for ages, but one cryptocurrency-focused venture capitalist ponders bitcoin will eventually capture that mantle.

Thereby, this marks the subsequent stride in the institutionalization of cryptocurrencies and accessing the market to investors like those that invest in traditional markets.

Technically, BTCUSD has constantly been sliding ever since the occurrences of hanging man patterns at $8,179.5 levels. The bears have been evidencing considerable price slumps below DMAs (refer daily plotting).

On the contrary, the pair has been holding stronger at $5,755 levels since last couple of months. Consequently, the bulls have attempted to bounce back above 21-DMAs.

Overall, the trend still seems to be edgy, and for those dubious on potential dips who are holding BTCs, on hedging grounds good to add shorts in CME BTC futures contracts for September delivery with a view of arresting upside risks at any time.

Currency Strength Index: FxWirePro's hourly BTC is inching at -50 (which is bearish), USD spot index is flashing at -56 levels (which is bearish), while articulating (at 08:01 GMT). For more details on the index, please refer below weblink:

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary