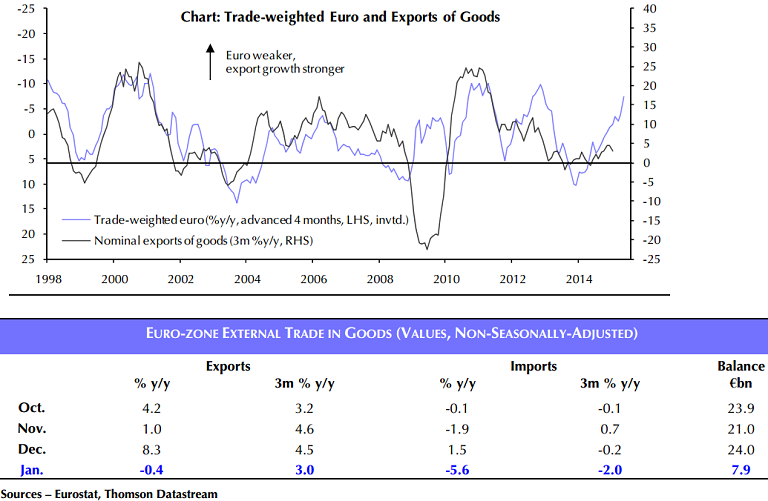

Euro-zone non-seasonally-adjusted trade surplus rose from €0.1bn in Jan 2014 to €7.9bn - its strongest Jan outturn since the single currency's creation. But this was only because the 5.6% y/y fall in imports outpaced the 0.4% decline in exports.

January's euro-zone trade data suggested that the region's exports are still not benefiting substantially from the weakness of the euro.

Capital Economics notes as follows ...

- Looking ahead, we expect the external sector to fare better in the coming months.

- On past form, the depreciation of the euro in trade-weighted terms points to a pick-up in annual export growth to around 15% later this year. And exporters should also benefit from solid growth in the US and UK.

- But today's data are a reminder that it will take time for the full effects of the currency's recent fall to be felt.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX