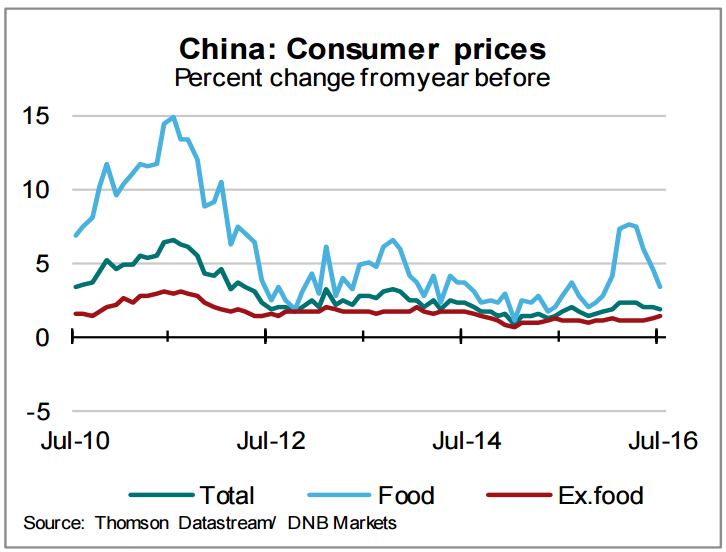

Data released earlier on Tuesday by the National Bureau of Statistics showed that China's CPI inflation came in at 1.8 percent y/y in July, largely in line with market expectations and compared to 1.9 percent in June. On a m/m basis, the CPI rose 0.2 percent in July, after four consecutive months of decline.

Food inflation fell 1.3pp to 3.3 percent y/y. Core-inflation (ex food) was up 0.2pp at 1.4 percent. Overall inflation fell due to lower food inflation, which was due to a drop in vegetable prices. Core inflation (ex-food) looked fairly stable. Vegetable prices, which rose a whopping 20 percent in the first half of the year, decelerated during the peak summer growing season contributing to the drop in the headline number.

China’s Producer Price Index fell 1.7 percent in July from a year earlier, which was a smaller decline than economists expected and compares with a 2.6 percent on-year drop in June. The index has lingered in deflationary territory for more than four years, but the decline has narrowed since the beginning of this year. China’s factory-gate deflation eased for the seventh straight month, signaling improving conditions for the nation’s manufacturers.

"Looking ahead, we expect headline consumer price inflation to begin to edge up again in the coming months. Non-food inflation is set to rise further as the drop in oil prices in the second half of 2015 provides a weaker base for comparison. Meanwhile, flooding in large parts of China last month, which damaged crops and killed livestock, will likely put upward pressure on food inflation in the short-run," said Capital Economics ' China economist Julian Evans-Pritchard.

People's Bank of China policymakers have an inflation target of around 3 percent. Price growth last year was 1.4 percent, a six-year low. Under-target mainland China inflation figure stoked expectations that the PBoC could move more aggressively to stimulus. Also, data released on Monday showed China’s imports fell by more than 12 percent in July, signaling weak domestic demand. And the official purchasing managers’ index in July dipped into contractionary territory for the first time since February.

“These price indicators are very stable compared to before,” said BBVA Research economist Xia Le. “But growth is still anemic. There’s still room for authorities to do more stimulus.”

Asian stocks rose to the highest level in almost a year as commodity producers rallied after Chinese data bolstered optimism that the world’s second-largest economy is stabilizing. China's CSI300 index closed up 0.7 pct at 3,256.98 points while Hong Kong’s Hang Seng index closed down 0.1 pct at 22,465.61 points.

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings