Business sentiment indicator of the France's central bank is likely to release today. The French flash services PMI figure was revised upwards from 52.3 to 52.7 last week.

The business sentiment indicator of the central bank is expected increase from 97 to 98 for October, estimates Societe Generale. The indicator is expected to be driven by the increased disposable income and higher corporate profit margins.

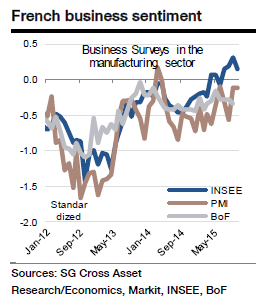

As the above chart shows, the indicator has enough scope to reach the PMIs and the reliable INSEE survey, and exceeding to 99 is likely to be possible (long-term average = 100).

Bank of France October business sentiment to perform well

Monday, November 9, 2015 4:45 AM UTC

Editor's Picks

- Market Data

Most Popular

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks