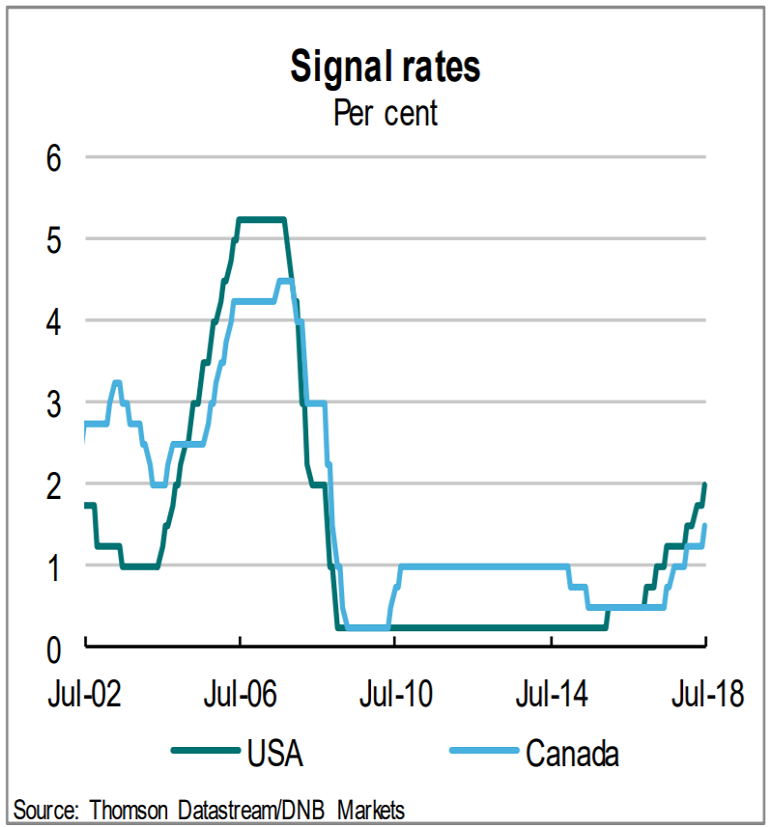

The Bank of Canada (BoC) raised its benchmark policy rate to 1.5 percent, up from 1.25 percent on Wednesday as widely expected. It was the fourth rate increase in the last 12 months. After having cut rates aggressively during the last two major downturns, the central bank is now slowly getting rates back to more normal levels.

The BoC struck a slightly hawkish tone in the statement that followed. Moving forward, the bank said it expects higher interest rates will be necessary over time to keep inflation near its target. However, it added that the rate path is going to be a gradual, data-dependent approach. The market is now pricing in a high probability (67 percent) for a hike in October.

Data from Statistics Canada suggest the economy is expanding, the job market is doing well, and inflation is inching higher. Canada's GDP-growth is above potential and capacity utilization remains high. In its latest Monetary Policy Report (MPR), the Bank forecasts growth of 2.0 percent this year (unchanged from the April MPR), followed by 2.2 percent and 1.9 percent in 2019 and 2020. Inflation is expected to average around 2.5 percent over the second half of 2018, but this is the result of temporary factors, with inflation forecast to be roughly back on target by the end of next year.

Meanwhile, underlying risks related to housing markets and household debt already argue for caution in the pace of hikes. External threats in the form of global trade disputes and uncertainty surrounding the difficult renegotiation of NAFTA (for which talks have stalled) loom large. BoC for now looks committed to a rate hike cycle, but will likely leave sufficient room to adjust to evolving events.

"We maintain a slightly cautious growth outlook. We still look for more hikes, but think a gradual pace of one hike roughly every two quarters still makes the most sense. NAFTA resolution and/or receding trade threats would certainly lay the ground work for an additional hike this year, but we won't hold our breath," said TD Economics in a report.

The CAD only gained marginally following BoC rate decision yesterday. USD/CAD hit session lows at 1.3064, but quickly reversed losses to close higher at 1.3208. The major is trading in a narrow range on he day, with the day's high at 1.3218 and low at 1.3181. Price action has retraced dip below 21-EMA, bias remains higher. We see weakness only on decisive break below 110-EMA at 1.2929.

FxWirePro's Hourly USD Spot Index was at 162.335 (Bullish), while Hourly CAD Spot Index was at 104.875 (Bullish) at 1115 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary