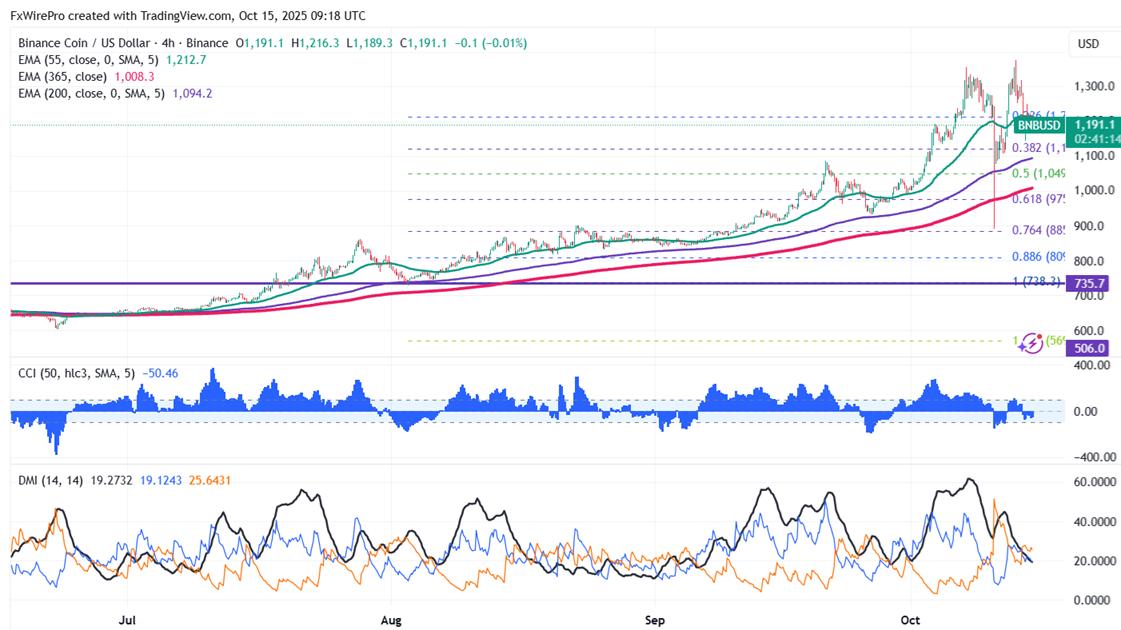

BNBUSD trades in a narrow range after a minor sell-off from a fresh all-time high. It hit an intraday high of $1216 and is currently trading around $1198.

Oscillators and moving averages to forecast the trend of BNBUSD

CMP- $1180.8

EMA (4-hour chart)

55-EMA- $1213.50

200-EMA- $1093.30

365-EMA- $1007. The pair trades above both short-term and long-term moving averages.

Major support - $1130. Any breach below $1130 will drag the pair down to $1086/$1044/$985/$930.

Major Resistance - $1250. Any break above $1250 confirms minor bullishness; a jump to $1300/$1376/$1400/$1500 is possible.

Indicators (4-hour chart)

CCI(50)- Bearish

ADX- Neutral

Investment Strategy for BNBUSD

It is good to buy on dips around $1130 with a stop loss around $1100 for target profits of $1300/$1350.