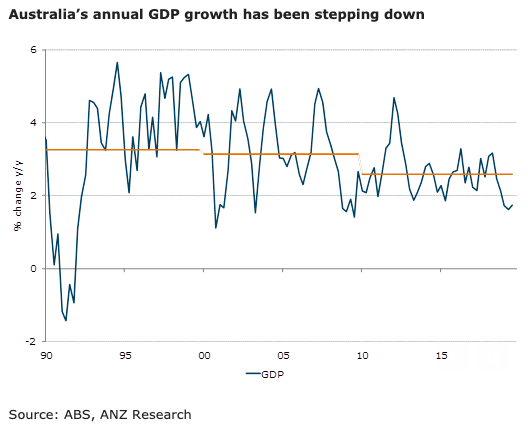

Australia’s trend rate of growth for the coming decade is expected to be somewhere between 2.0 percent and 2.5 percent per year, lower than the estimates from the Australian Treasury and the Reserve Bank of Australia (RBA), according to the latest report from ANZ Research.

This slowdown has been blamed on a drop in productivity growth. It is, at least partly, global in nature. There might be an endogenous element as well, caused by lower non-mining business investment.

The policy implications of this are mixed. Lower trend growth means that less growth acceleration is required to shift unemployment lower. This may not make monetary policy easier, however, as the factors pushing the trend lower may lessen its effectiveness. Lower trend growth poses challenges for the fiscal outlook, the report added.

"Critically, however, the slowdown in trend doesn’t have to be meekly accepted. If the primary cause of the slowdown is endogenous then there are potential policy options that can reverse it. To be specific, the policy focus should be on lifting investment," ANZ Research further commented in the report.

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains