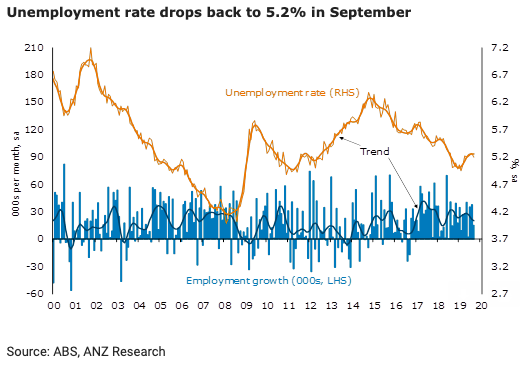

The 14.7k rise in employment in September was the smallest in seven months, aside from the post-election correction in June. However, the 0.1ppt fall in the participation rate to 66.1 percent meant that it was enough to bring the unemployment rate back down to 5.2 percent, ANZ Research reported.

Full-time employment increased by 26.2k, more than making up the previous month’s loss, while part-time employment fell 11.4k.

The fall in the participation rate was entirely due to males, with the female participation rate holding steady at the record high of 61.2 percent. Yet the male unemployment rate actually increased to 5.4 percent, due to a 6.7k decline in employment, while the female unemployment rate dropped to 5.0 percent on the back of a solid 21.4k rise in employment.

Along with unemployment, the underemployment rate fell 0.2ppt to 8.3 percent, bringing underutilisation down to 13.5 percent from 13.8 percent in the previous month. However, it remains 0.5ppt higher than its February low of 13.0 percent.

Still, the reduction in slack provides the RBA with some near-term breathing space and reduces the prospect of another rate cut as soon as November, the report added.

Not for long, though. With employment growth expected to slow in the near-term, we could see the unemployment rate drift up again. The outlook is dependent on the participation rate. High household debt and persistently low wage growth may be encouraging people to stay in the workforce longer or additional household members to look for work.

"These push factors could keep participation higher than we would otherwise expect as employment growth slows, driving up unemployment and preventing the RBA from its goal to “reach full employment," ANZ Research further commented.

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target