Australia’s investor lending rose during the month of August as the effects of June/July rate cuts and APRA changes have continued to flow through to housing finance, according to the latest report from ANZ Research.

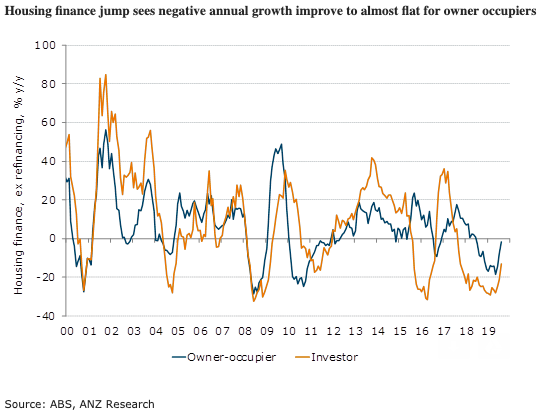

Investor lending was up 5.7 percent m/m in August ex-refinancing, the second-strongest monthly result since May 2015 and a continuation of investor demand after a 4.7 percent m/m result in July 2019. Annual growth in investor lending is still sharply negative (-13.0 percent y/y to July), however this is the smallest negative result in almost two years.

Owner-occupier lending grew 1.9 percent m/m in August ex refinancing. Annual growth is still slightly negative (-1.7 percent y/y), but it is the smallest negative result since June 2018, when y/y owner-occupier demand growth was still positive.

Regulatory easing in July (APRA relaxed the 7 percent + floors on mortgage serviceability) has heightened the effects of rate cuts, by allowing lower rates to more directly affect serviceability assessments, the report added.

"Optimism in the housing market following a sharp uptick in Sydney and Melbourne prices may have also spurred on extra demand from investors," ANZ further commented in the report.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed