The Australia Industry Group (AiG) performance construction index (PCI) plunged to 46.6 in August, down from 51.6 the previous month. Data showed on Wednesday that Australia’s construction industry fell back into contraction in August with weak house building, which slumped 13.8 points to 41.1 points acting as the major drag.

Breakdown of the monthly performance by subsector showed that while housing construction activity plunged, levels for apartment, commercial and engineering construction all expanded at a modest clip. Details were in line with recent data on building approvals and public infrastructure spending.

The new orders subindex which is a lead indicator on futures activity levels in the sector fell by 6.2 points to 45.5. New orders in house building decreased by 14.9 points to 39.3 points, points to a further softening in house building activity in coming months and follows a 0.5 percent m/m fall (-2.9 percent p.a.) in private sector house approvals in July. Apartment orders came in at 50.3, down 2.7 points on July. The measures on new orders for engineering and commercial construction also declined, falling to 47.0 points and 48.1 points respectively.

Housing Industry Association chief economist Harley Dale said, "The residential construction cycle was peaking and the index suggests there is not enough non-residential building work to sustain the sector."

The Australian government released official second quarter GDP estimates earlier today which showed real Gross Domestic Product (GDP) rose by 0.5 percent in the June quarter, slightly below expectations for an increase of 0.6 percent. The year-on-year growth rate accelerated to 3.3 percent, the fastest seen in four years.

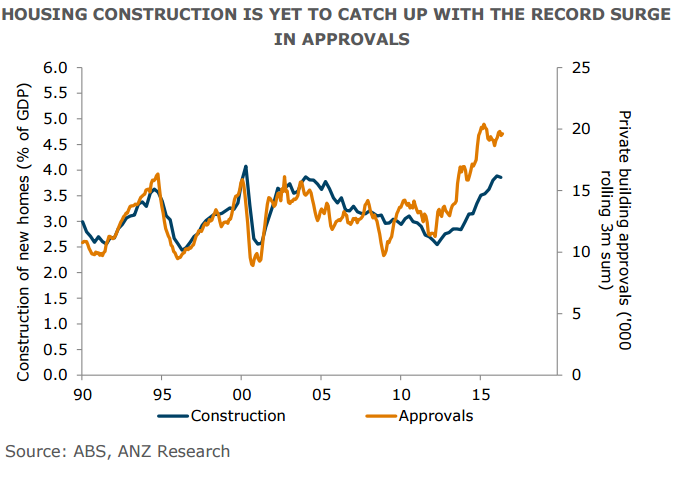

Details of the report showed that real residential investment rose another 2 percent in Q2, up 8 percent over the past year. Although this rise was driven by renovations to existing homes in the quarter, new construction is likely to retain momentum given a record backlog of work. ANZ estimates the backlog (which is concentrated in apartments) has about two years’ worth of construction yet to come.

"This suggests to us that housing activity will continue to pick up into next year, although we are concerned that construction will fall sharply once the backlog is exhausted," said ANZ in a report.

AUD/USD spiked higher to break 20-DMA (0.7618) and major trendline resistance at 0.7640. Techs poised for more gains. We see bullish 5-DMA crossover on 10-DMA. MACD has also evidenced a bullish crossover on signal line. Major support levels - 0.7635 (trendline resistance turned support), 0.7616 (20-DMA), 0.7609 (5-DMA). While major resistance levels lie at 0.77, 0.7740 (trendline), 0.7749 (Aug 16 high).

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure