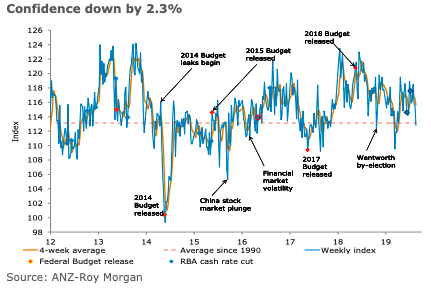

Australia’s ANZ-Roy Morgan consumer confidence fell 2.3 percent last week, closing below the long-term average. The fall was driven by weakness in economic conditions, with current falling 3.8 percent and future losing a massive 7.9 percent.

Both the economic sub-indices are below their respective long-term average. In contrast, the measures relating to personal finances rose modestly. Current finances were up by 0.2 percent for the week, while future finances gained 0.6 percent.

The 'Time to buy a major household item' index fell 1.4 percent - its third consecutive decline. The four-week moving average for inflation expectations fell by 0.1ppt to 3.9 percent. Weekly readings of inflation expectations have shown signs of weakness over the last few weeks.

"Australian households appear to be troubled by negative global economic developments and the related equity market weakness, with sentiment toward current and future economic conditions down sharply. Views about current economic conditions have fallen materially for three weeks in a row, while those for future economic conditions are at their weakest since October/November last year. The relative buoyancy of sentiment about personal financial conditions indicates that the tax cuts and lower interest rates are having a positive impact on households. But this hasn’t been sufficient to offset the global news flow. The more negative view on the economic outlook is impacting inflation expectations. The past three weeks have seen weekly readings of less than 4 percent," said David Plank, ANZ’s Head of Australian Economics.

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022