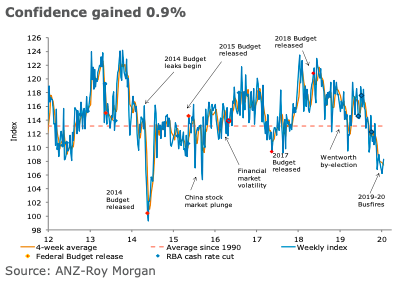

Australia’s ANZ-Roy Morgan consumer confidence continued with its forward march, gaining 0.9 percent last week. This takes it back to where it was in mid-December. The financial and economic sub-indices were mixed, while the ‘Time to buy a household item’ strengthened solidly.

Current finances gained 3.4 percent vis-a-vis weakness of 5.5 percent seen in the previous reading. In contrast, future finances declined 2.5 percent, reversing some of the 4.6 percent gain seen over the three previous surveys.

Current economic conditions gained 2.2 percent, while future economic conditions fell by 3 percent. These sub-indices were up 6.1 percent and 8.6 percent, respectively, in the previous reading.

‘Time to buy a major household item’ was up 4.7 percent, to its highest level since October. Four-week moving average of ‘inflation expectations’ was stable at 3.9 percent. However, the weekly reading was back above 4 percent after two weeks of being below.

"The gain in consumer confidence seen for the second straight week was encouraging, considering the weakness seen in the first reading of the current year. Overall sentiment remains well below average and quite some way below where it was before the RBA started easing in 2019, however. Some welcome rain during the week may have contributed to the overall rise in sentiment, along with some reasonable local data and the signing of the US-China trade deal Phase One. The attainment of a new record for the local share market could also have played a role. The domestic focus this week will be very much on the employment report. A soft result may dampen sentiment somewhat," said David Plank, ANZ Head of Australian Economics.

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure