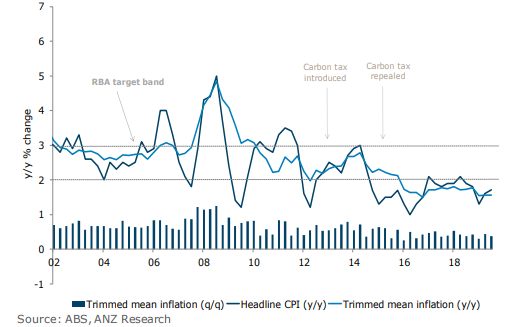

Australia’s headline inflation decelerated slightly on a quarter-on-quarter basis in the third quarter from the prior quarter. Meanwhile, on a year-on-year basis, the consumer price inflation accelerated a bit to 1.7 percent from second quarter’s 1.6 percent. International travel and accommodation prices were the biggest contributor to the headline print. Tobacco prices rose 3.4 percent. Meanwhile, fruit and vegetable prices dropped 2.8 percent and fuel prices fell 2 percent, partially offsetting the rises.

The Reserve Bank of Australia’s preferred measure of inflation, trimmed mean inflation, came in at 0.4 percent on a quarter-on-quarter basis, which saw the annual number unchanged at 1.6 percent. The RBA, in its August SoMP, had projected the trimmed mean inflation at 1.6 percent year-on-year in December 2019, suggesting an average of 0.4 percent for the third and fourth quarters. Therefore, a print of 0.4 percent is consistent with its expectation and will not cause it any additional concern, noted ANZ in a research report.

Significantly, domestic market service inflation accelerated in the third quarter, rising 0.5 percent quarter-on-quarter compared to prior quarter’s 0.1 percent rise. Nevertheless, this still leaves annual growth at just 1.4 percent, well below its long-term average of 2.2 percent. With jobless rate rising and private sector wages decelerating slightly, the fourth quarter is not expected to record a large acceleration in market service inflation.

Tradable prices continued to grow solidly, rising 0.9 percent quarter-on-quarter, which showed throughout the tradables basket, as they rose 1.1 percent quarter-on-quarter. The softer AUD in the quarter is expected to have had some effect. Non-tradable prices rose more slowly, rising 0.4 percent quarter-on-quarter. There are continued signals that retail prices are stabilizing.

“We estimate retail prices, excluding fruit & veg, alcohol and tobacco, will have increased 0.3 percent q/q – the third quarter of positive price growth in a row. This follows 13 consecutive quarters of falling prices”, said ANZ.

Housing inflation came in weak, with rental inflation rising just 0.1 percent quarter-on-quarter and new dwelling purchase prices dropping 0.2 percent quarter-on-quarter for the third consecutive quarter. With a rebound in housing construction unlikely until next year, continued softness in housing related inflation is expected for the fourth quarter of this year.

Today’s print gives it some flexibility around the timing of the next rate cut; and a move next week is materially less than a 50 percent likelihood, said ANZ.

“However, we still think the RBA will eventually need to ease further if it is to drive spare capacity out of the labour market and get the unemployment rate down towards 4.5%”, added ANZ.

Australian annual headline inflation accelerates marginally in Q3 2019, RBA unlikely to cut rate next week

Wednesday, October 30, 2019 5:15 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022