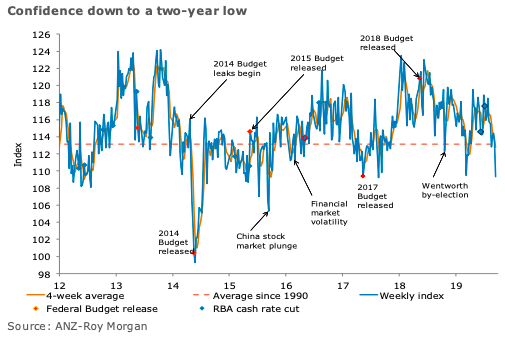

Australia’s ANZ-Roy Morgan consumer confidence plunged 3.5 percent last week to its lowest level in over two years. ‘Time to buy a household item’ was the only sub-index in the positive, eking out a 0.2 percent gain.

The financial conditions subcomponents dropped sharply. Current finances were down 4.6 percent, the third consecutive weekly decline, while future finances were down 4.8 percent.

The economic conditions sub-indices were also down, with current economic conditions losing 0.6 percent and future economic conditions falling by a sharp 7.6 percent, bringing it to a two-year low.

The four-week moving average for inflation expectations increased by 0.1ppt to 4.1 percent, despite a small decline in the weekly reading.

"ANZ-Roy Morgan consumer confidence fell to two year low last week. While households feel okay about their current financial situation, they are clearly quite worried about the outlook, for both their own finances and the economy. Last week’s reported fall in business conditions to a five-year low, the weekend attack on Saudi Arabia’s oil and ongoing broader concerns about both the domestic and global economic outlook are now clearly weighing on consumer sentiment. This is a disappointing development and suggests that expectations for tax and interest rate cuts to spur the consumer to lift the economy may be misplaced," said Felicity Emmett, ANZ Senior Economist.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility