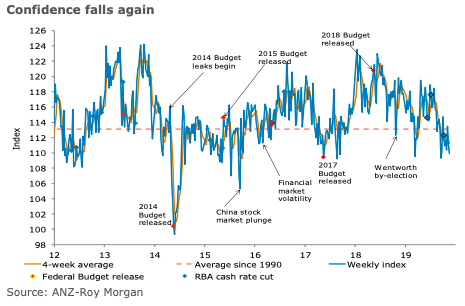

Australia’s ANZ-Roy Morgan consumer confidence was down again last week, falling 1.1 percent. The weakness was predominantly due to the economic conditions component of the index. Current economic conditions fell by 2.6 percent, while future economic conditions were more downbeat, falling 4.9 percent.

Both these sub-indices are near their multiyear lows. In contrast, financial conditions were upbeat, with current financial conditions gaining 0.3 percent and future financial conditions gaining 0.2 percent. The ‘Time to buy a household item’ gained 0.4 percent after falling 3.9 percent in the previous reading.

The four-week moving average of inflation expectations declined by 0.1ppt to 3.9 percent as the weekly reading fell to 3.8 percent, its lowest level since the end of June.

"Confidence faltered again due to weakness in the two economic conditions sub-indices. Continued weakness in these sub-indices has caused poor performance of the index for some time. Labour market data last week revealed that the job market weakened last month, which is probably the reason why the economic conditions sub-indices have been down for the last few weeks. Confirmation that wages are still subdued may also have made households apprehensive about the economic outlook, even if it doesn’t seem to be impacting them directly via financial conditions. Renewed weakness in the weekly reading of inflation expectations will be a concern for the RBA," said David Plank, ANZ’s Head of Australian Economics.

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January