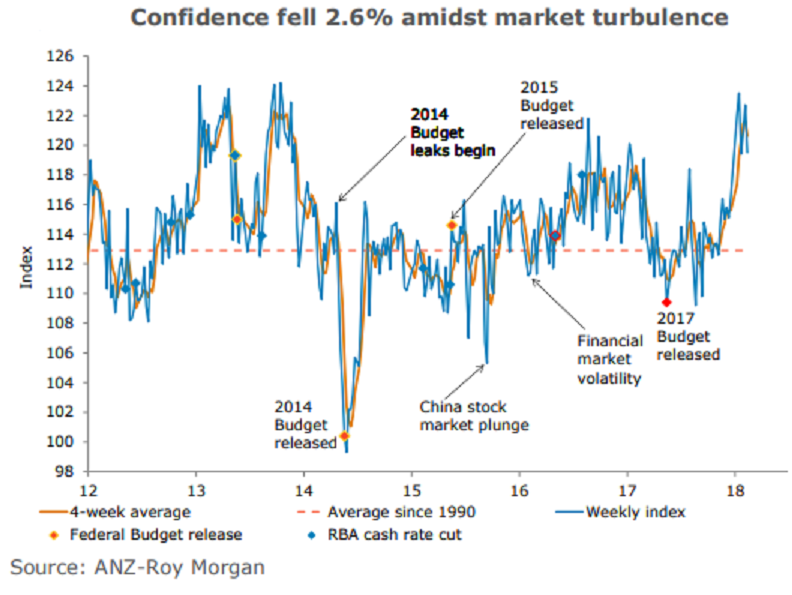

Australia’s ANZ-Roy Morgan consumer confidence fell 2.6 percent last week to 119.5, retracing gains over the previous two weeks. All sub-indices posted declines, though the ‘current economic conditions’ sub-index was the main culprit.

Households’ sentiment towards current economic conditions dropped a sharp 6 percent, unwinding much of the 8.3 percent cumulative rise over the previous two weeks. Views towards future conditions slipped 0.7 percent, its second straight weekly fall.

Consumers were also less optimistic about financial conditions this week. Views towards current and future conditions fell 2.6 percent and 1.8 percent respectively. In four week moving average terms, aggregate financial conditions sit at 116.0, down from their high of 118.5, two weeks ago.

Sentiment around the ‘time to buy a household item’ fell for the fourth straight week, slipping 1.9 percent to 136.9. Inflation expectations edged down to 4.4 percent on a four-week basis.

"Together with moderating house prices and high levels of debt, household finances remain under pressure. On this front, Governor Lowe’s speech last week, which in our view effectively removed the prospect of a rate hike this year, should provide some comfort. The upcoming employment and wage numbers will likely set the tone for confidence over the coming weeks. Further financial market volatility may also have an impact," said David Plank, Head of Australian Economics, ANZ Research.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility